Page 116 - Ord 866 Adopting a revised Fiscal Year 17-18 and new proposed Fiscal Year 18-19 budget

P. 116

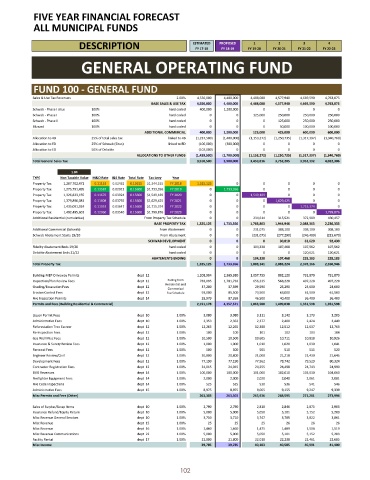

FIVE YEAR FINANCIAL FORECAST

ALL MUNICIPAL FUNDS

ESTIMATED PROPOSED 1 2 3 4

DESCRIPTION FY 17- 18 FY 18- 19 FY 19- 20 FY 20- 21 FY 21- 22 FY 22- 23

GENERAL OPERATING FUND

FUND 100 - GENERAL FUND

Sales & Use Tax Revenues 2.00% 4,550, 000 4,400, 000 4,488, 088 4,577, 940 4,669, 590 4,763, 075

BASE SALES & USE TAX 4,550, 000 4,400, 000 4,488, 088 4,577, 940 4,669, 590 4,763, 075

Schwab - Phase I situs 100% hard coded 400, 000 1,200, 000 0 0 0 0

Schwab - Phase I 100% hard coded 0 0 125, 000 250, 000 250, 000 250, 000

Schwab - Phase II 100% hard coded 0 0 0 125, 000 250, 000 250, 000

Blizzard 100% hard coded 0 0 0 50, 000 100, 000 100, 000

ADDITIONAL COMMERCIAL 400, 000 1,200, 000 125, 000 425, 000 600, 000 600, 000

Allocation to 4B 25% of total sales tax linked to 4B ( 1,237, 500)( 1,400, 000)( 1,153, 272)( 1,250, 735)( 1,317, 397)( 1,340, 769)

Allocation to ED 25% of Schwab ( Situs) linked to ED ( 100, 000)( 300, 000) 0 0 0 0

Allocation to ED 50% of Deloitte ( 102, 000) 0 0 0 0 0

ALLOCATIONS TO OTHER FUNDS ( 1,439, 500)( 1,700, 000)( 1,153, 272)( 1,250, 735)( 1,317, 397)( 1,340, 769)

Total General Sales Tax 3,510, 500 3,900, 000 3,459, 816 3,752, 205 3,952, 192 4,022, 306

1.04

TYPE Non Taxable Value M& O Rate I&S Rate Total Rate Tax Levy Year

Property Tax 1,207, 702, 471 0. 11133 0. 02482 0. 13615 $ 1,344, 535 FY 2018 1,325, 125 0 0 0 0 0

Property Tax 1,275, 791, 495 0. 13587 0. 02013 0. 15600 $ 1,733, 356 FY 2019 0 1,733, 356 0 0 0 0

Property Tax 1,326, 823, 155 0. 11676 0. 03924 0. 15600 $ 1,549, 189 FY 2020 0 0 1,549, 189 0 0 0

Property Tax 1,379, 896, 081 0. 11808 0. 03792 0. 15600 $ 1,629, 425 FY 2021 0 0 0 1,629, 425 0 0

Property Tax 1,435, 091, 924 0. 11953 0. 03647 0. 15600 $ 1,715, 374 FY 2022 0 0 0 0 1,715, 374 0

Property Tax 1,492, 495, 601 0. 12060 0. 03540 0. 15600 $ 1,799, 876 FY 2023 0 0 0 0 0 1,799, 876

Additional Residential ( cumulative) From Property Tax Schedule 0 0 234, 614 315, 521 372, 989 430, 457

BASE PROPERTY TAX 1,325, 125 1,733, 356 1,783, 803 1,944, 946 2,088, 363 2,230, 333

Additional Commercial ( Schwab) From Abatement 0 0 231, 075 308, 100 308, 100 308, 100

Schwab Abatement Starts 19/ 20 From Abatement 0 0 ( 231, 075)( 277, 290)( 246, 480)( 215, 670)

SCHWAB DEVELOPMENT 0 0 0 30, 810 61, 620 92, 430

Fidelity Abatement Ends 19/ 20 hard coded 0 0 104, 338 107, 468 107, 562 107, 562

Deloitte Abatement Ends 21/ 22 hard coded 0 0 0 0 120, 621 120, 621

ABATEMENTS ENDING 0 0 104, 338 107, 468 228, 183 228, 183

Total Property Tax 1,325, 125 1,733, 356 1,888, 141 2,083, 224 2,378, 166 2,550, 946

Building- MEP- Driveway Permits dept 12 1,208, 904 2,365, 380 1,057, 755 802, 120 731, 870 731, 870

Inspection/ Plan Review Fees dept 12 Pulling from 783, 095 1,781, 733 656, 235 568, 228 497, 228 497, 228

Residential and

Grading/ Excavation Fees dept 12 37, 200 37, 599 29, 590 25, 290 24, 600 24, 600

Commerical

Erosion Control Fees dept 12 Fee Schedule 93,000 85,500 73,500 63,000 61,500 61,500

Fire Inspection Permits dept 14 28, 979 87, 359 46, 500 40, 400 36, 400 36, 400

Permits and Fees ( Building Residential & Commercial) 2,151, 178 4,357, 571 1,863, 580 1,499, 038 1,351, 598 1,351, 598

Liquor Permit Fees dept 10 1.00% 3,080 3,080 3,111 3,142 3,173 3,205

Administrative Fees dept 10 1.00% 2,353 2,353 2,377 2,400 2,424 2,449

Reforestation Tree Escrow dept 12 1.00% 12,265 12,265 12,388 12,512 12,637 12,763

Re- Inspection Fees dept 12 1.00% 100 100 101 102 103 104

Gas Well Misc Fees dept 12 1.00% 10,500 10,500 10,605 10,711 10,818 10,926

Insurance & Surety Review Fees dept 12 1.00% 1,000 1,000 1,010 1,020 1,030 1,041

Renewal Fees dept 12 1.00% 500 500 505 510 515 520

Engineer Review/ Civil dept 12 1.00% 20, 800 20, 800 21, 008 21, 218 21, 430 21, 645

Development Fees dept 12 1.00% 77,190 77,190 77,962 78,742 79,529 80,324

Contractor Registration Fees dept 12 1.00% 24, 015 24, 015 24, 255 24, 498 24, 743 24, 990

EMS Revenues dept 14 1.00% 100, 000 100, 000 101, 000 102, 010 103, 030 104, 060

Firefighter Equipment Fees dept 14 1.00% 2,000 2,000 2,020 2,040 2,061 2,081

Fire Code Inspections dept 14 1.00% 525 525 530 536 541 546

Administrative Fees dept 15 1.00% 8,975 8,975 9,065 9,155 9,247 9,339

Misc Permits and Fees ( Other) 263, 303 263, 303 265, 936 268, 595 271, 281 273, 994

Sales of Surplus/ Scrap Items dept 10 1.00% 2,790 2,790 2,818 2,846 2,875 2,903

Insurance Refund/ Equity Return dept 10 1.00% 5,000 5,000 5,050 5,101 5,152 5,203

Misc Revenue General Services dept 10 1.00% 3,710 3,710 3,747 3,785 3,822 3,861

Misc Revenue dept 15 1.00% 25 25 25 26 26 26

Misc Revenue dept 16 1.00% 1,460 1,460 1,475 1,489 1,504 1,519

Misc Revenue Communications dept 22 1.00% 5,000 5,000 5,050 5,101 5,152 5,203

Facility Rental dept 17 1.00% 21, 800 21, 800 22, 018 22, 238 22, 461 22, 685

Misc Income 39, 785 39, 785 40, 183 40, 585 40, 991 41, 400

102