Page 112 - Ord 866 Adopting a revised Fiscal Year 17-18 and new proposed Fiscal Year 18-19 budget

P. 112

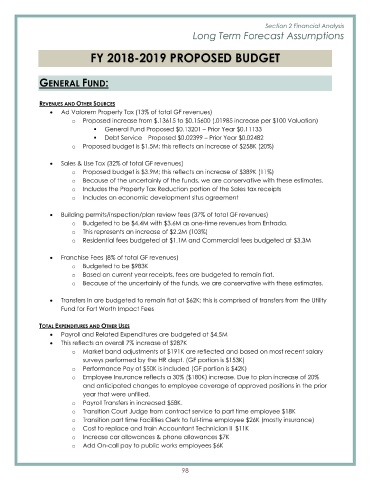

Section 2 Financial Analysis

Long Term Forecast Assumptions

FY 2018-2019 PROPOSED BUDGET

GENERAL FUND:

REVENUES AND OTHER SOURCES

Ad Valorem Property Tax ( 13% of total GF revenues)

o Proposed increase from $.13615 to $0.15600 (. 01985 increase per $100 Valuation)

General Fund Proposed $ 0.13201 – Prior Year $ 0.11133

Debt Service Proposed $ 0.02399 – Prior Year $0.02482

o Proposed budget is $ 1.5M; this reflects an increase of $258K ( 20%)

Sales & Use Tax ( 32% of total GF revenues)

o Proposed budget is $ 3.9M; this reflects an increase of $389K ( 11%)

o Because of the uncertainly of the funds, we are conservative with these estimates.

o Includes the Property Tax Reduction portion of the Sales tax receipts

o Includes an economic development situs agreement

Building permits/ inspection/ plan review fees (37% of total GF revenues)

o Budgeted to be $4.4M with $3.6M as one-time revenues from Entrada.

o This represents an increase of $2.2M (103%)

o Residential fees budgeted at $1.1M and Commercial fees budgeted at $3.3M

Franchise Fees ( 8% of total GF revenues)

o Budgeted to be $983K

o Based on current year receipts, fees are budgeted to remain flat.

o Because of the uncertainly of the funds, we are conservative with these estimates.

Transfers In are budgeted to remain flat at $62K; this is comprised of transfers from the Utility

Fund for Fort Worth Impact Fees

TOTAL EXPENDITURES AND OTHER USES

Payroll and Related Expenditures are budgeted at $4.5M

This reflects an overall 7% increase of $287K

o Market band adjustments of $191K are reflected and based on most recent salary

surveys performed by the HR dept. (GF portion is $ 153K)

o Performance Pay of $50K is included ( GF portion is $ 42K)

o Employee Insurance reflects a 30% ($180K) increase. Due to plan increase of 20%

and anticipated changes to employee coverage of approved positions in the prior

year that were unfilled.

o Payroll Transfers in increased $ 58K.

o Transition Court Judge from contract service to part time employee $ 18K

o Transition part time Facilities Clerk to full-time employee $ 26K ( mostly insurance)

o Cost to replace and train Accountant Technician II $ 11K

o Increase car allowances & phone allowances $ 7K

o Add On-call pay to public works employees $ 6K

98