Page 18 - 2019 Budget Detail.xlsx

P. 18

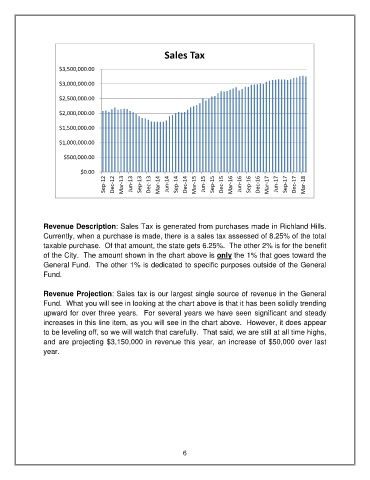

Sales Tax

$3,500,000.00

$3,000,000.00

$2,500,000.00

$2,000,000.00

$1,500,000.00

$1,000,000.00

$500,000.00

$0.00

Sep‐12 Dec‐12 Mar‐13 Jun‐13 Sep‐13 Dec‐13 Mar‐14 Jun‐14 Sep‐14 Dec‐14 Mar‐15 Jun‐15 Sep‐15 Dec‐15 Mar‐16 Jun‐16 Sep‐16 Dec‐16 Mar‐17 Jun‐17 Sep‐17 Dec‐17 Mar‐18

Revenue Description: Sales Tax is generated from purchases made in Richland Hills.

Currently, when a purchase is made, there is a sales tax assessed of 8.25% of the total

taxable purchase. Of that amount, the state gets 6.25%. The other 2% is for the benefit

of the City. The amount shown in the chart above is only the 1% that goes toward the

General Fund. The other 1% is dedicated to specific purposes outside of the General

Fund.

Revenue Projection: Sales tax is our largest single source of revenue in the General

Fund. What you will see in looking at the chart above is that it has been solidly trending

upward for over three years. For several years we have seen significant and steady

increases in this line item, as you will see in the chart above. However, it does appear

to be leveling off, so we will watch that carefully. That said, we are still at all time highs,

and are projecting $3,150,000 in revenue this year, an increase of $50,000 over last

year.

6