Page 43 - Cover 3.psd

P. 43

BUDGET OVERVIEW

Also notable is the increase in funding being transferred to capital projects, $35,000 of which

is being transferred to help cover the cost of the reconstruction of Schiller Drive (CDBG19)

and $40,157 for reimbursement to the Public Safety Technology Project for the cost of body

cameras and related equipment for the City Marshals.

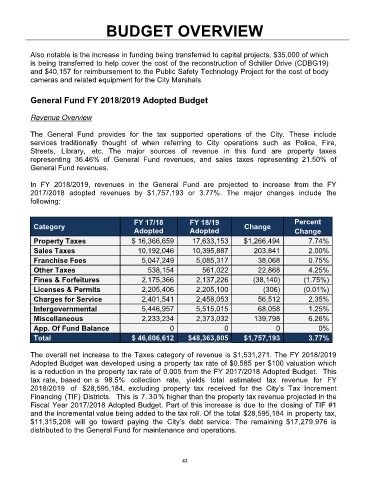

General Fund FY 2018/2019 Adopted Budget

Revenue Overview

The General Fund provides for the tax supported operations of the City. These include

services traditionally thought of when referring to City operations such as Police, Fire,

Streets, Library, etc. The major sources of revenue in this fund are property taxes

representing 36.46% of General Fund revenues, and sales taxes representing 21.50% of

General Fund revenues.

In FY 2018/2019, revenues in the General Fund are projected to increase from the FY

2017/2018 adopted revenues by $1,757,193 or 3.77%. The major changes include the

following:

FY 17/18 FY 18/19 Percent

Category Change

Adopted Adopted Change

Property Taxes $ 16,366,659 17,633,153 $1,266,494 7.74%

Sales Taxes 10,192,046 10,395,887 203,841 2.00%

Franchise Fees 5,047,249 5,085,317 38,068 0.75%

Other Taxes 538,154 561,022 22,868 4.25%

Fines & Forfeitures 2,175,366 2,137,226 (38,140) (1.75%)

Licenses & Permits 2,205,406 2,205,100 (306) (0.01%)

Charges for Service 2,401,541 2,458,053 56,512 2.35%

Intergovernmental 5,446,957 5,515,015 68,058 1.25%

Miscellaneous 2,233,234 2,373,032 139,798 6.26%

App. Of Fund Balance 0 0 0 0%

Total $ 46,606,612 $48,363,805 $1,757,193 3.77%

The overall net increase to the Taxes category of revenue is $1,531,271. The FY 2018/2019

Adopted Budget was developed using a property tax rate of $0.585 per $100 valuation which

is a reduction in the property tax rate of 0.005 from the FY 2017/2018 Adopted Budget. This

tax rate, based on a 98.5% collection rate, yields total estimated tax revenue for FY

2018/2019 of $28,595,184, excluding property tax received for the City’s Tax Increment

Financing (TIF) Districts. This is 7 . 3 0 % higher than the property tax revenue projected in the

Fiscal Year 2017/2018 Adopted Budget. Part of this increase is due to the closing of TIF #1

and the incremental value being added to the tax roll. Of the total $28,595,184 in property tax,

$11,315,208 will go toward paying the City’s debt service. The remaining $17,279,976 is

distributed to the General Fund for maintenance and operations.

43