Page 40 - Cover 3.psd

P. 40

BUDGET OVERVIEW

FY 2017/2018 REVISED & FY 2018/2019 ADOPTED BUDGET

HIGHLIGHTS

As part of the regular annual budget process, some areas of the FY 2017/2018 budget

require revision from the originally adopted level. Projecting revenues and expenditures can

be difficult because they are being predicted up to fourteen months before they occur.

Revenues and expenditures are tracked throughout the year and adjustments are made to the

Adopted Budget in order to complete the fiscal year.

General Fund FY 2017/2018 Revised Budget

Revenue Overview

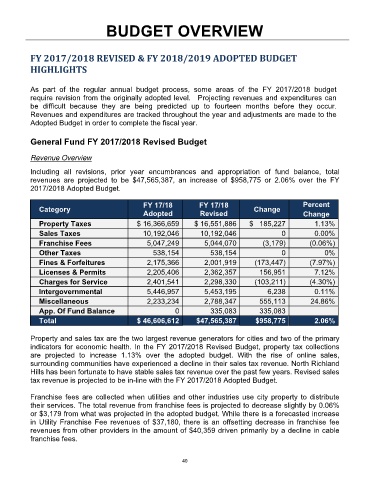

Including all revisions, prior year encumbrances and appropriation of fund balance, total

revenues are projected to be $47,565,387, an increase of $958,775 or 2.06% over the FY

2017/2018 Adopted Budget.

FY 17/18 FY 17/18 Percent

Category Change

Adopted Revised Change

Property Taxes $ 16,366,659 $ 16,551,886 $ 185,227 1.13%

Sales Taxes 10,192,046 10,192,046 0 0.00%

Franchise Fees 5,047,249 5,044,070 (3,179) (0.06%)

Other Taxes 538,154 538,154 0 0%

Fines & Forfeitures 2,175,366 2,001,919 (173,447) (7.97%)

Licenses & Permits 2,205,406 2,362,357 156,951 7.12%

Charges for Service 2,401,541 2,298,330 (103,211) (4.30%)

Intergovernmental 5,446,957 5,453,195 6,238 0.11%

Miscellaneous 2,233,234 2,788,347 555,113 24.86%

App. Of Fund Balance 0 335,083 335,083

Total $ 46,606,612 $47,565,387 $958,775 2.06%

Property and sales tax are the two largest revenue generators for cities and two of the primary

indicators for economic health. In the FY 2017/2018 Revised Budget, property tax collections

are projected to increase 1.13% over the adopted budget. With the rise of online sales,

surrounding communities have experienced a decline in their sales tax revenue. North Richland

Hills has been fortunate to have stable sales tax revenue over the past few years. Revised sales

tax revenue is projected to be in-line with the FY 2017/2018 Adopted Budget.

Franchise fees are collected when utilities and other industries use city property to distribute

their services. The total revenue from franchise fees is projected to decrease slightly by 0.06%

or $3,179 from what was projected in the adopted budget. While there is a forecasted increase

in Utility Franchise Fee revenues of $37,180, there is an offsetting decrease in franchise fee

revenues from other providers in the amount of $40,359 driven primarily by a decline in cable

franchise fees.

40