Page 48 - Cover 3.psd

P. 48

BUDGET OVERVIEW

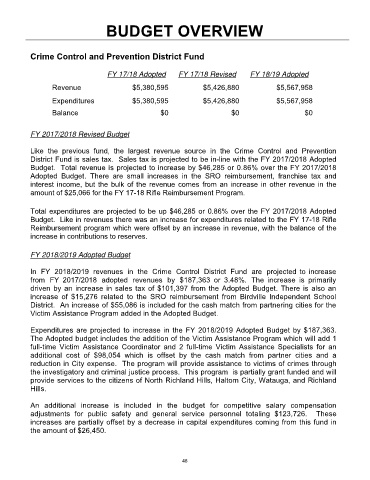

Crime Control and Prevention District Fund

FY 17/18 Adopted FY 17/18 Revised FY 18/19 Adopted

Revenue $5,380,595 $5,426,880 $5,567,958

Expenditures $5,380,595 $5,426,880 $5,567,958

Balance $0 $0 $0

FY 2017/2018 Revised Budget

Like the previous fund, the largest revenue source in the Crime Control and Prevention

District Fund is sales tax. Sales tax is projected to be in-line with the FY 2017/2018 Adopted

Budget. Total revenue is projected to increase by $46,285 or 0.86% over the FY 2017/2018

Adopted Budget. There are small increases in the SRO reimbursement, franchise tax and

interest income, but the bulk of the revenue comes from an increase in other revenue in the

amount of $25,066 for the FY 17-18 Rifle Reimbursement Program.

Total expenditures are projected to be up $46,285 or 0.86% over the FY 2017/2018 Adopted

Budget. Like in revenues there was an increase for expenditures related to the FY 17-18 Rifle

Reimbursement program which were offset by an increase in revenue, with the balance of the

increase in contributions to reserves.

FY 2018/2019 Adopted Budget

In FY 2018/2019 revenues in the Crime Control District Fund are projected to increase

from FY 2017/2018 adopted revenues by $187,363 or 3.48%. The increase is primarily

driven by an increase in sales tax of $101,397 from the Adopted Budget. There is also an

increase of $15,276 related to the SRO reimbursement from Birdville Independent School

District. An increase of $55,086 is included for the cash match from partnering cities for the

Victim Assistance Program added in the Adopted Budget.

Expenditures are projected to increase in the FY 2018/2019 Adopted Budget by $187,363.

The Adopted budget includes the addition of the Victim Assistance Program which will add 1

full-time Victim Assistance Coordinator and 2 full-time Victim Assistance Specialists for an

additional cost of $98,054 which is offset by the cash match from partner cities and a

reduction in City expense. The program will provide assistance to victims of crimes through

the investigatory and criminal justice process. This program is partially grant funded and will

provide services to the citizens of North Richland Hills, Haltom City, Watauga, and Richland

Hills.

An additional increase is included in the budget for competitive salary compensation

adjustments for public safety and general service personnel totaling $123,726. These

increases are partially offset by a decrease in capital expenditures coming from this fund in

the amount of $26,450.

48