Page 56 - Grapevine FY19 Operating Budget

P. 56

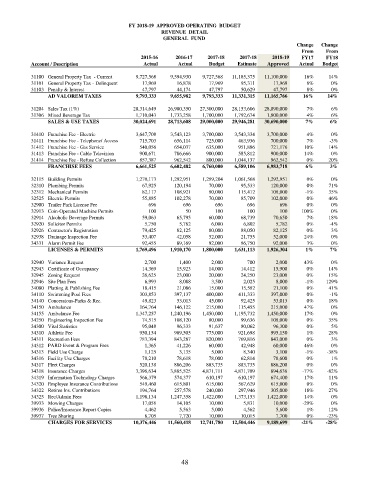

FY 2018-19 APPROVED OPERATING BUDGET

REVENUE DETAIL

GENERAL FUND

Change Change

From From

2015-16 2016-17 2017-18 2017-18 2018-19 FY17 FY18

Account / Description Actual Actual Budget Estimate Approved Actual Budget

31100 General Property Tax - Current 9,727,568 9,594,930 9,727,568 11,185,375 11,100,000 16% 14%

31101 General Property Tax - Delinquent 17,969 16,878 17,969 95,311 17,969 6% 0%

31103 Penalty & Interest 47,797 44,174 47,797 50,629 47,797 8% 0%

AD VALOREM TAXES 9,793,333 9,655,982 9,793,333 11,331,315 11,165,766 16% 14%

31204 Sales Tax (1%) 28,314,649 26,980,350 27,300,000 28,153,606 28,890,000 7% 6%

31306 Mixed Beverage Tax 1,710,043 1,733,258 1,700,000 1,792,674 1,800,000 4% 6%

SALES & USE TAXES 30,024,691 28,713,608 29,000,000 29,946,281 30,690,000 7% 6%

31410 Franchise Fee - Electric 3,647,708 3,543,123 3,700,000 3,543,334 3,700,000 4% 0%

31411 Franchise Fee - Telephone/ Access 715,703 656,114 725,000 463,936 700,000 7% -3%

31412 Franchise Fee - Gas Service 540,056 654,037 635,000 951,886 721,176 10% 14%

31413 Franchise Fee - Cable Television 900,671 786,666 900,000 585,812 900,000 14% 0%

31414 Franchise Fee - Refuse Collection 857,387 962,542 800,000 1,044,137 962,542 0% 20%

FRANCHISE FEES 6,661,525 6,602,482 6,760,000 6,589,106 6,983,718 6% 3%

32115 Building Permits 1,270,173 1,292,951 1,289,204 1,061,568 1,292,951 0% 0%

32310 Plumbing Permits 67,925 120,194 70,000 95,533 120,000 0% 71%

32312 Mechanical Permits 82,117 108,921 80,000 115,412 108,000 -1% 35%

32525 Electric Permits 55,885 102,278 70,000 85,709 102,000 0% 46%

32900 Trailer Park License Fee 696 696 696 696 696 0% 0%

32913 Coin-Operated Machine Permits 100 50 100 100 100 100% 0%

32914 Alcoholic Beverage Permits 59,063 65,795 60,000 68,739 70,650 7% 18%

32920 Solicitor Permits 5,750 5,782 6,000 6,802 5,782 0% -4%

32926 Contractor's Registration 79,425 82,125 80,000 88,050 82,125 0% 3%

32938 Drainage Inspection Fee 53,407 42,058 52,000 21,755 52,000 24% 0%

34331 Alarm Permit Fee 92,455 89,169 92,000 86,750 92,000 3% 0%

LICENSES & PERMITS 1,769,496 1,910,170 1,800,000 1,631,113 1,926,304 1% 7%

32940 Variance Request 2,700 1,400 2,000 700 2,000 43% 0%

32943 Certificate of Occupancy 14,369 15,923 14,000 14,412 15,900 0% 14%

32945 Zoning Request 26,625 23,000 20,000 24,250 23,000 0% 15%

32946 Site Plan Fees 6,993 8,088 3,500 2,025 8,000 -1% 129%

34080 Platting & Publishing Fee 18,415 21,086 15,000 15,582 21,100 0% 41%

34110 Swimming Pool Fees 303,853 397,137 400,000 411,333 397,000 0% -1%

34140 Concessions-Parks & Rec. 49,823 53,013 45,000 92,425 53,013 0% 18%

34150 Ambulance 164,764 146,122 215,000 115,455 215,000 47% 0%

34155 Ambulance Fee 1,347,257 1,240,196 1,450,000 1,195,732 1,450,000 17% 0%

34250 Engineering Inspection Fee 74,515 108,120 80,000 99,636 108,000 0% 35%

34300 Vital Statistics 95,048 96,333 91,637 80,062 96,300 0% 5%

34310 Athletic Fee 950,154 989,505 775,000 921,698 995,150 1% 28%

34311 Recreation Fees 783,394 843,287 820,000 769,816 843,000 0% 3%

34312 PARD Event & Program Fees 1,365 41,226 60,000 42,948 60,000 46% 0%

34313 Field Use Charge 1,125 3,135 5,000 8,340 3,100 -1% -38%

34316 Facility Use Charges 78,210 78,618 78,000 62,814 78,600 0% 1%

34317 Fleet Charges 520,138 886,206 883,735 883,735 886,200 0% 0%

34318 Insurance Charges 3,396,634 3,885,525 4,871,711 4,871,709 894,636 -77% -82%

34319 Information Technology Charges 566,379 574,377 610,197 610,197 674,400 17% 11%

34320 Employee Insurance Contributions 549,460 615,801 615,000 567,629 615,000 0% 0%

34322 Retiree Ins. Contributions 194,764 257,578 240,000 297,946 305,000 18% 27%

34325 Rec/Admin Fees 1,198,134 1,247,358 1,422,000 1,373,153 1,422,000 14% 0%

39933 Mowing Charges 17,058 14,105 10,000 5,831 10,000 -29% 0%

39936 Police/Insurance Report Copies 4,462 5,563 5,000 4,562 5,600 1% 12%

39937 Tree Sharing 8,705 7,720 10,000 10,015 7,700 0% -23%

CHARGES FOR SERVICES 10,376,446 11,560,418 12,741,780 12,504,446 9,189,699 -21% -28%

48