Page 426 - City of Arlington FY19 Adopted Operating Budget

P. 426

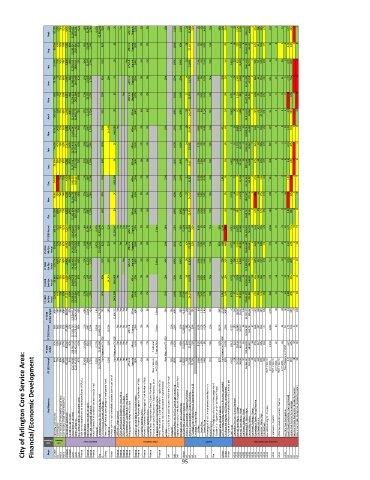

56.22% 105% 78% 81% 4,450 100% $838,230 61% 16% $1,064 1.74% 0.47% $2,682,648 82% 21% $0 Yes Affirm & Upgrade 100% 0% 0% 16% 100% 100% 34 $1,449 52% 1% 0% 0.6% 75% 88% 636 39% 0 28 2,296 2,182 $362,724 54,625 37% (96) 24% 178 190 0 13 2 4.57 43%

Sept. $1,385,422 5 3 1 9

69.73% 43% 76% 79% 7,132 99% $950,638 61% 16% $1,064 1.74% 82% $0 Affirm & Upgrade 100% 0% 0% 100% 93% 38 $3,397 1% 0% 0.3% 75% 4% 0 19 220 1,200 $5,551,793 69,153 52% 61 76% 177 30 5 1 0 4.48 34%

Aug. $1,565,334 6 1 2 8

52.04% 77% 76% 78% 6,898 99% $958,185 71% 16% $1,064 1.74% 82% $0 Yes Affirm & Upgrade 100% 0% 0% 100% 100% 32 $1,868 0.4% 0% 0.3% 75% 5% 0.001 19 320 15,203 $537,143 68,773 79% 51 46% 178 50 6 16 0 4.79 65%

July $1,350,523 4 1 1 3

70.78% 90 77% 86% 6,497 98% $847,668 61% 17% $1,055 1.72% 82% 19% $0 Affirm & Upgrade 100% 0% 0% 16% 100% 100% 34 $1,701 0.8% 0% 0.1% 74% 256 2% 0 104 1,165 1,491 67,079 86% 64 25% 178 604 10 19 0 4.72 70%

June $1,388,453 9 $1,291,394 3 1 1

68% 103 77% 85% 6,935 98% $823,084 60% 17% $1,055 1.72% 82% $0 Yes Affirm & Upgrade 100% 0% 0% 100% 100% 30 $1,450 1% 0.6% 0.4% 74% 8% 0.001 66 1,118 893 50,831 65% 49 25% 179 84 2 9 0 0 62%

May $1,374,171 7 $5,477,043 1 4 3

280.02% 109 77% 85% 5,998 100% $1,449,811 $1,065,177 73% 17% $1,055 1.72% 82% $0 Affirm 100% 0% 0% 100% 100% 26 $4,244 1% 0% 0.1% 75% 2% 0.003 16 62 1,985 $3,541,521 66,866 42% 44 37.74% 179 54 3 4 0 4.8 59%

April 6 1 1 1 1

66.91% 142% 73% 85% 6,683 100% 66% 17% $997 1.79% 80% 14.14% $480,000 Yes Affirm 100% 0% 0% 18% 100% 99% 28 $3,843 0.8% 0% 0.4% 74% 401 6% 0 16 3,699 9,241 55,459 59% 57 28% 179 150 3 4 12 4.59 56%

Mar. $1,692,247 $1,111,420 5 1 $2,850,764 6 2 6

74.63% 60% 73% 85% 5,016 100% $1,799,471 $1,178,847 66% 17% $997 1.79% 80% $0 Affirm 100% 0% 0% 100% 100% 34 $1,392 0.7% 0% 0% 73% 5% 0 16 1,732 14,129 $218,162 42,867 45% 52 29% 179 280 8 2 0 4.73 40%

Feb. 8 7 1 5

58.39% 56% 73% 85% 6,385 100% $1,077,661 $782,755 73% 17% $997 1.79% 80% $0 Affirm 100% 0% 0% 100% 100% 24 $3,857 0.6% 0.6% 0% 73% 5% 0.002 10 2,539 12,722 $857,658 42,368 27% 60 22% 177 305 5 3 0 4.6 40%

Jan. 3 1 2 1 6

54.83% 17% 75% 82% 4,458 100% $986,387 $629,114 64% 17% $997 1.79% 80% $806,300 Affirm 100% 0% 0% 20% 100% 100% 21 $2,037 0.6% 0.3% 0.2% 76% 1,043 7% 0 12 0 11,433 113,037 27% 38 19% 174 441 2 2 0 4.31 14%

Dec. 8 $1,142,418 0 2 5

56.9% 52% 74% 74% 6,243 100% $733,449 64% 17% $997 1.79% 80% $0 Affirm 100% 0% 0% 100% 100% 27 $4,517 0.5% 0.3% 0.2% 75% 5% 0.003 14 751 11,479 $950,067 72,114 14% 52 17% 172 228 7 2 55 0 35%

Nov. $1,149,733 8 2 2 9

560.58% 188% 75% 71% 6,852 100% $857,021 72% 17% $997 1.79% 80% $0 Affirm 100% 0% 0% 100% 100% 0.21% 23 $5,414 0.9% 0.0% 0.4% 75% 6% 0 25 880 47 $548,737 46,531 42% 25 12% 171 200 3 3 0 4.99 68%

Oct. $1,182,634 2 2 3 6

FY 2018 Actual 106.7% 81% 78% 81% 73,547 100% $16,401,847 $10,775,588 66% 16% $1,064 1.74% 0.47% $2,682,648 81% 21% $1,286,300 Yes Yes Yes Yes Affirm & Upgrade 100% 0% 0% 5 Stars 19% 100% 99% 0.21% 357 $2,929 52% 8.9% 2% 3% 75% 88% 2,336 94% 0.010 345 14,782 82,005 1 9 $23,329,424 749,703 9 2 51% 457 30% 178 2,616 57 78 69 4.73 51% 2 2 2 7

FY 2018 4th Qtr. Actual 59.33% 75% 78% 81% 18,480 99% $4,301,279 $2,747,053 64% 16% $1,064 1.74% 0.47% $2,682,648 82% 21% $0 Yes Yes Affirm & Upgrade 100% 0% 0% 19% 100% 97% 104 $2,290 52% 2.1% 0.3% 1.2% 75% 88% 636 48% 0.001 66 2,836 18,585 5 1 $6,451,660 192,551 5 56% 16 49% 178 270 14 30 2 4.61 52% 4 0 2

FY 2018 3rd Qtr. Actual 139.77% 100% 77% 86% 19,430 99% $4,212,435 $2,735,929 65% 17% $1,055 1.72% 82% 19% 0% Yes Affirm & Upgrade 100% 0% 0% 5 Stars 16% 100% 100% 90 $2,936 2.8% 0.6% 0.6% 74% 256 12% 0.004 186 2,345 4,369 2 2 $10,309,958 184,776 5 63% 157 29% 178 742 15 32 0 4.76 66% 6 5 1

FY 2018 2nd Qtr. Actual 66.64% 85% 73% 85% 18,084 100% $4,569,379 $3,073,022 67% 17% $99 1.79% 80% 14.14% $480,000 Yes Affirm 100% 0% 0% 18% 100% 99% 86 $2,878 2.1% 0.3% 0.4% 73% 401 16% 0.002 42 7,970 36,092 6 3 $3,926,584 140,694 5 1 48% 169 26% 179 735 16 9 12 4.64 48% 4 7 1

FY 2018 1st Qtr. Actual 224.1% 66% 75% 82% 17,553 100% $3,318,754 $2,219,584 67% 17% $997 1.79% 80% $806,300 Affirm 100% 0% 0% 20% 100% 100% 0.21% 71 $4,074 1.91% 0.6% 0.7% 76% 1,043 18% 0.003 51 1,631 22,959 8 1 $2,641,222 231,682 4 31% 115 16% 178 869 12 7 55 4.88 38% 7 0 2

FY 2018 Annual Target 100% 90% 80% 108% 80,000 97% $16,384,615 $10,650,000 65% <20% $1,180 <2% 0.6% $2,700,000 70% 20% $1,000,000 Yes Yes Yes Yes Affirm 100% <1% 0% 5 Stars 25% 75% 100% 95% <0.5% 359 $3,057 75% 9% 1.3% 2.6% 75% 90% 2,128 100% <2 340 28,000 55,000 5 1 1 $5,750,000 585,000 2 4 42% 390 30% 185 3,000 80 80 50 4.8 65% 7 2 0 0 1

FY 2017 Actual 88% 86% 76% 87% 87,209 97% $17,201,760 $11,379,523 66% 17% $997 1.79% 0.33% $2,683,011 10.79% Yes Yes Yes Yes Affirm & Upgrade 100% 0% 0% 5 Stars 75% 100% 97% 0.2563% 362 $3,247 59% 6.3% 2.2% 4.1% 75% 89.5% 100% 0.020 290 31,963 63,547 6 9 $6,024,880 658,754 7 4 56% 387 28% 171 3,030 80 81 53 4.71 53% 1 3 5 7

90% 82% 79% 107% 90,020 80% 66% 17.41% $956 1.81% 0.27% 12% Yes Yes Yes Yes Affirm 100% <1% 0% 75% 100% 98% 0.322% 364 $2,800 71% 9.2% 1.5% 3% 73% 91% 100% 0.011 325 25,324 68,132 584,837 47% 410 29% 193 2,394 60 59 4.67 54%

FY 2016 FY 2015 Actual Actual 94% 75% 80% 108% 85,115 94% $18,746,413 $19,776,696 $12,420,771 $13,156,378 67% 17.45% $884 1.71% 0.22% $2,833,896 $2,791,860 New Measure in FY 2018 6.5% New Measure in FY 2018 Yes Yes Yes Yes Affirm & Upgrade 100% <1% 0% Traditional New Measure Finance Star in FY 2016 New Measure in FY 2018 75% 100% 91% 0.322% 355 $2,236 75.79% 8.6% 0.0% 3.6% 71% 92% New Measure in FY 2018 95% 0.022 41

City of Arlington Core Service Area: Financial/Economic Development Key Measures Operating cost recovery Cost Recovery Cost recovery of Parks Performance Fund Cost recovery of Golf Performance Fund Total aircraft operations Hangar occupancy rate Gross Revenue collected Revenue Retained % of revenue retained (less state costs) Debt service expenditures to total expenditures of GF plus Debt Service Net tax‐supported debt per capita Net debt to assessed valuation Actual

Categories

Recovery

Policy Compliance

Budgetary Issues

Goal

Cost

Aviation

Aviation

Aviation

Finance

Dept.

Finance

Finance

Finance

Finance

Finance

Finance

Finance

Finance

Finance

Finance

Finance

Finance

Finance

Library

Parks

Parks

Water

Water

Court

Court

Court

MR

MR

Fire

MR

CC

IT

95 HR HR HR HR HR Benefits Fire Library Water Water ACVB ACVB ACVB ACVB ACVB ACVB ACVB ACVB ACVB ACVB ACVB ACVB ACVB Convention and Tourism Sales ACVB ACVB CC CC CC CC