Page 15 - WestworthVillageFY26AdoptedBudget

P. 15

15

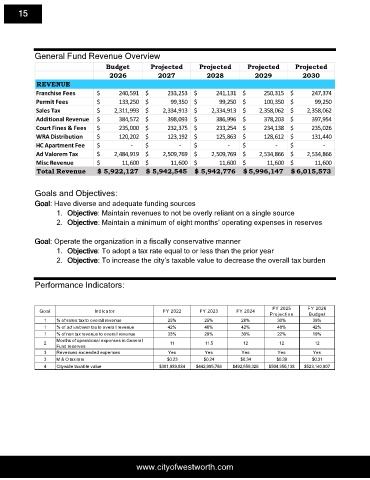

General Fund Revenue Overview

Budget Projected Projected Projected Projected

2026 2027 2028 2029 2030

REVENUE

Franchise Fees $ 240,591 $ 233,253 $ 241,131 $ 250,315 $ 247,374

Permit Fees $ 133,250 $ 99,350 $ 99,250 $ 100,350 $ 99,250

Sales Tax $ 2,311,993 $ 2,334,913 $ 2,334,913 $ 2,358,062 $ 2,358,062

Additional Revenue $ 384,572 $ 398,093 $ 386,996 $ 378,203 $ 397,954

Court Fines & Fees $ 235,000 $ 232,375 $ 233,254 $ 234,138 $ 235,026

WRA Distribution $ 120,202 $ 123,192 $ 125,863 $ 128,612 $ 131,440

HC Apartment Fee $ - $ - $ - $ - $ -

Ad Valorem Tax $ 2,484,919 $ 2,509,769 $ 2,509,769 $ 2,534,866 $ 2,534,866

Misc Revenue $ 11,600 $ 11,600 $ 11,600 $ 11,600 $ 11,600

Total Revenue $ 5,922,127 $ 5,942,545 $ 5,942,776 $ 5,996,147 $ 6,015,573

Goals and Objectives:

Goal: Have diverse and adequate funding sources

1. Objective: Maintain revenues to not be overly reliant on a single source

2. Objective: Maintain a minimum of eight months’ operating expenses in reserves

Goal: Operate the organization in a fiscally conservative manner

1. Objective: To adopt a tax rate equal to or less than the prior year

2. Objective: To increase the city’s taxable value to decrease the overall tax burden

Performance Indicators:

FY 2025 FY 2026

Goal Indicator FY 2022 FY 2023 FY 2024

Projection Budget

1 % of sales tax to overall revenue 25% 25% 28% 30% 39%

1 % of ad valorem tax to overall revenue 42% 46% 42% 48% 42%

1 % of non tax revenue to overall revenue 33% 29% 30% 22% 19%

Months of operational expenses in General

2 11 11.5 12 12 12

Fund reserves

3 Revenues exceeded expenses Yes Yes Yes Yes Yes

3 M & O tax rate $0.23 $0.24 $0.34 $0.30 $0.31

4 Citywide taxable value $381,989,884 $442,995,786 $492,659,326 $504,350,138 $523,140,907

www.cityofwestworth.com