Page 8 - TownofWestlakeFY26BudgetOrd1029

P. 8

DEBT SERVICE

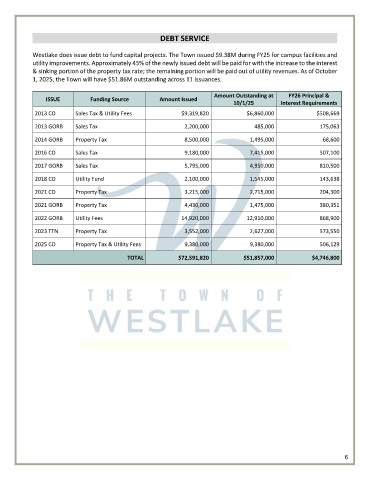

Westlake does issue debt to fund capital projects. The Town issued $9.38M during FY25 for campus facilities and

utility improvements. Approximately 45% of the newly issued debt will be paid for with the increase to the interest

& sinking portion of the property tax rate; the remaining portion will be paid out of utility revenues. As of October

1, 2025, the Town will have $51.86M outstanding across 11 issuances.

Amount Outstanding at FY26 Principal &

ISSUE Funding Source Amount Issued

10/1/25 Interest Requirements

2013 CO Sales Tax & Utility Fees $9,319,820 $6,860,000 $508,669

2013 GORB Sales Tax 2,200,000 485,000 175,063

2014 GORB Property Tax 8,500,000 1,495,000 68,600

2016 CO Sales Tax 9,180,000 7,415,000 507,100

2017 GORB Sales Tax 5,795,000 4,950,000 810,500

2018 CO Utility Fund 2,100,000 1,545,000 143,638

2021 CO Property Tax 3,215,000 2,715,000 204,300

2021 GORB Property Tax 4,430,000 1,475,000 380,351

2022 GORB Utility Fees 14,920,000 12,910,000 868,900

2023 TTN Property Tax 3,552,000 2,627,000 573,550

2025 CO Property Tax & Utility Fees 9,380,000 9,380,000 506,129

TOTAL $72,591,820 $51,857,000 $4,746,800

6