Page 7 - TownofWestlakeFY26BudgetOrd1029

P. 7

ANNUAL BUDGET

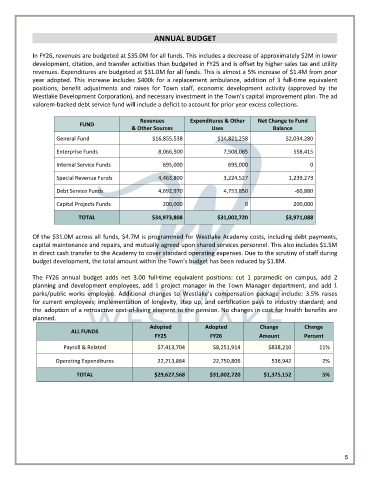

In FY26, revenues are budgeted at $35.0M for all funds. This includes a decrease of approximately $2M in lower

development, citation, and transfer activities than budgeted in FY25 and is offset by higher sales tax and utility

revenues. Expenditures are budgeted at $31.0M for all funds. This is almost a 5% increase of $1.4M from prior

year adopted. This increase includes $400k for a replacement ambulance, addition of 3 full-time equivalent

positions, benefit adjustments and raises for Town staff, economic development activity (approved by the

Westlake Development Corporation), and necessary investment in the Town’s capital improvement plan. The ad

valorem-backed debt service fund will include a deficit to account for prior year excess collections.

Revenues Expenditures & Other Net Change to Fund

FUND

& Other Sources Uses Balance

General Fund $16,855,538 $14,821,258 $2,034,280

Enterprise Funds 8,066,500 7,508,085 558,415

Internal Service Funds 695,000 695,000 0

Special Revenue Funds 4,463,800 3,224,527 1,239,273

Debt Service Funds 4,692,970 4,753,850 -60,880

Capital Projects Funds 200,000 0 200,000

TOTAL $34,973,808 $31,002,720 $3,971,088

Of the $31.0M across all funds, $4.7M is programmed for Westlake Academy costs, including debt payments,

capital maintenance and repairs, and mutually agreed upon shared services personnel. This also includes $1.5M

in direct cash transfer to the Academy to cover standard operating expenses. Due to the scrutiny of staff during

budget development, the total amount within the Town’s budget has been reduced by $1.8M.

The FY26 annual budget adds net 3.00 full-time equivalent positions: cut 1 paramedic on campus, add 2

planning and development employees, add 1 project manager in the Town Manager department, and add 1

parks/public works employee. Additional changes to Westlake’s compensation package include: 3.5% raises

for current employees; implementation of longevity, step up, and certification pays to industry standard; and

the adoption of a retroactive cost-of-living element to the pension. No changes in cost for health benefits are

planned.

Adopted Adopted Change Change

ALL FUNDS

FY25 FY26 Amount Percent

Payroll & Related $7,413,704 $8,251,914 $838,210 11%

Operating Expenditures 22,213,864 22,750,806 536,942 2%

TOTAL $29,627,568 $31,002,720 $1,375,152 5%

5