Page 6 - TownofWestlakeFY26BudgetOrd1029

P. 6

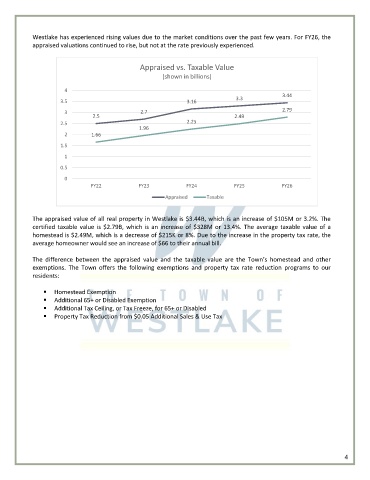

Westlake has experienced rising values due to the market conditions over the past few years. For FY26, the

appraised valuations continued to rise, but not at the rate previously experienced.

Appraised vs. Taxable Value

(shown in billions)

4

3.3 3.44

3.5 3.16

3 2.7 2.79

2.5 2.49

2.5 2.25

1.96

2 1.66

1.5

1

0.5

0

FY22 FY23 FY24 FY25 FY26

Appraised Taxable

The appraised value of all real property in Westlake is $3.44B, which is an increase of $105M or 3.2%. The

certified taxable value is $2.79B, which is an increase of $328M or 13.4%. The average taxable value of a

homestead is $2.49M, which is a decrease of $215K or 8%. Due to the increase in the property tax rate, the

average homeowner would see an increase of $66 to their annual bill.

The difference between the appraised value and the taxable value are the Town’s homestead and other

exemptions. The Town offers the following exemptions and property tax rate reduction programs to our

residents:

Homestead Exemption

Additional 65+ or Disabled Exemption

Additional Tax Ceiling, or Tax Freeze, for 65+ or Disabled

Property Tax Reduction from $0.05 Additional Sales & Use Tax

4