Page 144 - CityofSouthlakeFY26AdoptedBudget

P. 144

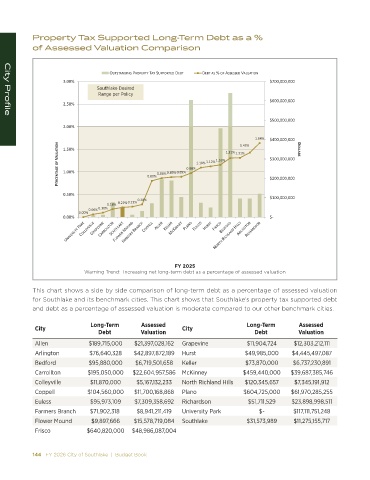

Property Tax Supported Long-Term Debt as a %

of Assessed Valuation Comparison

Khd^d E /E' WZKW Zdz d y ^hWWKZd d d ^ й K& ^^ ^^ s >h d/KE

ϯ͘ϬϬй ΨϳϬϬ͕ϬϬϬ͕ϬϬϬ

Southlake Desired

Range per Policy

ΨϲϬϬ͕ϬϬϬ͕ϬϬϬ

Ϯ͘ϱϬй

City Profile

ΨϱϬϬ͕ϬϬϬ͕ϬϬϬ

Ϯ͘ϬϬй

ϭ͘ϲϰй ΨϰϬϬ͕ϬϬϬ͕ϬϬϬ K>> Z^

W Z Ed ' K& s >h d/KE ϭ͘ϬϬй Ϭ͘ϴϬй Ϭ͘ϴϲй Ϭ͘ϴϵй Ϭ͘ϴϵй Ϭ͘ϵϴй ϭ͘ϭϬй ϭ͘ϭϮй ϭ͘ϭϲй ϭ͘ϯϭй ϭ͘ϯϭй ΨϯϬϬ͕ϬϬϬ͕ϬϬϬ

ϭ͘ϰϯй

ϭ͘ϱϬй

ΨϮϬϬ͕ϬϬϬ͕ϬϬϬ

Ϭ͘ϱϬй

Ϭ͘Ϯϴй ΨϭϬϬ͕ϬϬϬ͕ϬϬϬ

Ϭ͘ϮϮй Ϭ͘Ϯϯй

Ϭ͘ϭϴй

Ϭ͘Ϭϲй Ϭ͘ϭϬй

Ϭ͘ϬϬй

Ϭ͘ϬϬй ΨͲ

FY 2025

Warning Trend: Increasing net long-term debt as a percentage of assessed valuation

This chart shows a side by side comparison of long-term debt as a percentage of assessed valuation

for Southlake and its benchmark cities. This chart shows that Southlake’s property tax supported debt

and debt as a percentage of assessed valuation is moderate compared to our other benchmark cities.

Long-Term Assessed Long-Term Assessed

City City

Debt Valuation Debt Valuation

Allen $189,715,000 $21,397,028,162 Grapevine $11,904,724 $12,303,212,111

Arlington $76,640,328 $42,897,872,189 Hurst $49,985,000 $4,445,497,087

Bedford $95,880,000 $6,719,501,658 Keller $73,870,000 $6,737,230,891

Carrollton $195,050,000 $22,604,957,586 McKinney $459,440,000 $39,687,385,746

Colleyville $11,870,000 $5,167,132,233 North Richland Hills $120,345,657 $7,345,191,912

Coppell $104,560,000 $11,700,168,868 Plano $604,725,000 $61,970,285,255

Euless $95,973,109 $7,309,358,692 Richardson $51,711,529 $23,898,998,511

Farmers Branch $71,902,318 $8,941,211,419 University Park $- $117,111,751,248

Flower Mound $9,897,666 $15,578,719,084 Southlake $31,573,989 $11,275,155,717

Frisco $640,820,000 $48,986,087,004

144 FY 2026 City of Southlake | Budget Book FY 2026 City of Southlake | Budget Book 145