Page 143 - CityofEulessFY26AdoptedBudgetOrdinance2432

P. 143

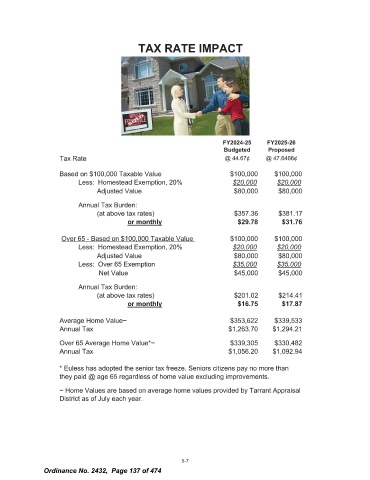

TAX RATE IMPACT

FY2024- 25 FY2025- 26

Budgeted Proposed

Tax Rate @ 44. 67¢ @ 47. 6466¢

Based on $ 100, 000 Taxable Value 100, 000 100, 000

Less: Homestead Exemption, 20% 20, 000 20, 000

Adjusted Value 80, 000 80, 000

Annual Tax Burden:

at above tax rates) 357. 36 381. 17

or monthly 29. 78 31. 76

Over 65 - Based on $ 100, 000 Taxable Value 100,000 100, 000

Less: Homestead Exemption, 20% 20, 000 20. 000

Adjusted Value 80, 000 80, 000

Less: Over 65 Exemption 35, 000 35. 000

Net Value 45, 000 45, 000

Annual Tax Burden:

at above tax rates) 201. 02 214. 41

or monthly 16. 75 17. 87

Average Home Value - 353, 622 $ 339, 533

Annual Tax 1, 263. 70 $ 1, 294. 21

Over 65 Average Home Value*_ 339, 305 $ 330, 482

Annual Tax 1, 056. 20 $ 1, 092. 94

Euless has adopted the senior tax freeze. Seniors citizens pay no more than

they paid @ age 65 regardless of home value excluding improvements.

Home Values are based on average home values provided by Tarrant Appraisal

District as of July each year.

5- 7

Ordinance No. 2432, Page 137 of 474