Page 141 - CityofEulessFY26AdoptedBudgetOrdinance2432

P. 141

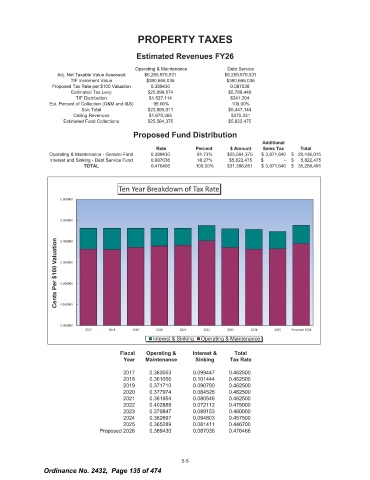

PROPERTY TAXES

Estimated Revenues FY26

Operating & Maintenance Debt Service

Adj. Net Taxable Value Assessed 6, 259, 970, 531 6, 259, 970, 531

TIF Increment Value 390, 666, 036 390, 666, 036

Proposed Tax Rate per $ 100 Valuation 0. 389430 0. 087036

Estimated Tax Levy 25, 899, 574 5, 788, 448

TIF Distribution 1, 527, 114 341, 304

Est. Percent of Collection ( O& M and I& S) 98. 00% 100. 00%

Sub Total 23, 885, 011 5, 447, 144

Ceiling Revenues 1, 679, 365 375, 331

Estimated Fund Collections 25, 564, 375 5, 822, 475

Proposed Fund Distribution

Additional

Rate Percent Amount Sales Tax Total

Operating & Maintenance - General Fund 0. 389430 81. 73% 25, 564, 375 3, 871, 640 $ 29, 436, 015

Interest and Sinking - Debt Service Fund 0. 087036 18. 27% 5, 822, 475 5, 822, 475

TOTAL 0. 476466 100. 00% 31, 386, 851 3, 871, 640 $ 35, 258, 491

Ten Year Breakdown of Tax Rate'

0. 600000

0.500000

0. 400000

Valuation 0. 300000

100

Per $ 0.200000

Cents 0. 100000

0. 000000

2017 2018 2019 2020 2021 2022 2023 2024 2025 Proposed 2026

I Interest & Sinking Operating & Maintenance'

Fiscal Operating & Interest & Total

Year Maintenance Sinking Tax Rate

2017 0. 363053 0. 099447 0. 462500

2018 0. 361056 0. 101444 0.462500

2019 0. 371710 0. 090790 0. 462500

2020 0. 377974 0. 084526 0. 462500

2021 0. 381954 0. 080546 0. 462500

2022 0. 402888 0. 072112 0. 475000

2023 0. 370847 0. 089153 0. 460000

2024 0. 362697 0. 094803 0. 457500

2025 0. 365289 0. 081411 0. 446700

Proposed 2026 0. 389430 0. 087036 0. 476466

5- 5

Ordinance No. 2432, Page 135 of 474