Page 139 - CityofEulessFY26AdoptedBudgetOrdinance2432

P. 139

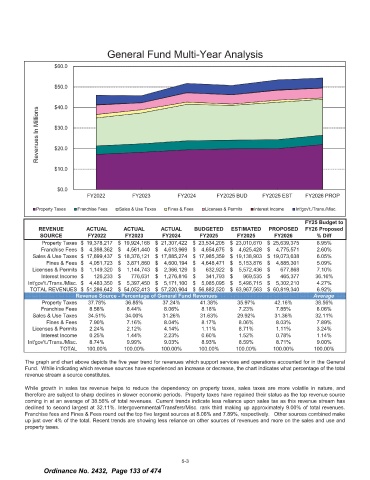

General Fund Multi -Year Analysis

60. 0

50. 0

40. 0

Millions

30. 0

In

Revenues 20. 0

10. 0

0. 0

FY2022 FY2023 FY2024 FY2025 BUD FY2025 EST FY2026 PROP

Property Taxes Franchise Fees Sales & Use Taxes Fines & Fees Licenses & Permits Interest Income Int' gov' t./ Trans./ Misc.

FY25 Budget to

REVENUE ACTUAL ACTUAL ACTUAL BUDGETED ESTIMATED PROPOSED FY26 Proposed

SOURCE FY2022 FY2023 FY2024 FY2025 FY2025 FY2026 Diff

Property Taxes $ 19, 378, 217 $ 19, 924, 168 $ 21, 307, 422 $ 23, 534, 205 $ 23, 010, 670 $ 25, 639, 375 8. 95%

Franchise Fees $ 4, 398, 362 $ 4, 561, 440 $ 4, 613, 969 $ 4, 654, 675 $ 4, 625, 428 $ 4, 775, 571 2. 60%

Sales & Use Taxes $ 17, 699,437 $ 18, 376, 121 $ 17, 885, 274 $ 17, 985,359 $ 19, 138, 903 $ 19, 073, 638 6. 05%

Fines & Fees $ 4, 051, 723 $ 3, 871, 860 $ 4, 600, 194 $ 4, 648, 471 $ 5, 153, 876 $ 4, 885, 301 5. 09%

Licenses & Permits $ 1, 149, 320 $ 1, 144, 743 $ 2, 366, 129 $ 632, 922 $ 5, 572, 436 $ 677, 868 7. 10%

Interest Income $ 126, 233 $ 776, 631 $ 1, 276, 816 $ 341, 793 $ 969, 535 $ 465, 377 36. 16%

Int' gov' t./ Trans./ Misc. $ 4, 483, 350 $ 5, 397, 450 $ 5, 171, 100 $ 5, 085, 095 $ 5, 496, 715 $ 5, 302, 210 4. 27%

TOTAL REVENUES $ 51, 286, 642 $ 54, 052, 413 $ 57, 220, 904 $ 56, 882, 520 $ 63, 967, 563 $ 60, 819, 340 6. 92%

Property Taxes 37. 78% 36. 85% 37. 24% 41. 38% 35. 97% 42. 16% 38. 56%

Franchise Fees 8. 58% 8. 44% 8. 06% 8. 18% 7. 23% 7. 85% 8. 06%

Sales & Use Taxes 34. 51% 34. 00% 31. 26% 31. 63% 29. 92% 31. 36% 32. 11%

Fines & Fees 7. 90% 7. 16% 8. 04% 8. 17% 8. 06% 8. 03% 7. 89%

Licenses & Permits 2. 24% 2. 12% 4. 14% 1. 11 % 8. 71% 1. 11% 3. 24%

Interest Income 0. 25% 1. 44% 2. 23% 0. 60% 1. 52% 0. 78% 1. 14%

I nt' gov' t./ Trans./ M isc. 8. 74% 9. 99% 9. 03% 8. 93% 8. 59% 8. 71 9. 00%

TOTAL 100. 00% 100. 00% 100. 00% 100. 00% 100. 00% 100. 00% 100. 00%

The graph and chart above depicts the five year trend for revenues which support services and operations accounted for in the General

Fund. While indicating which revenue sources have experienced an increase or decrease, the chart indicates what percentage of the total

revenue stream a source constitutes.

While growth in sales tax revenue helps to reduce the dependency on property taxes, sales taxes are more volatile in nature, and

therefore are subject to sharp declines in slower economic periods. Property taxes have regained their status as the top revenue source

coming in at an average of 38. 56% of total revenues. Current trends indicate less reliance upon sales tax as this revenue stream has

declined to second largest at 32. 11%. Intergovernmental/ Transfers/ Misc. rank third making up approximately 9. 00% of total revenues.

Franchise fees and Fines & Fees round out the top five largest sources at 8. 06% and 7. 89%, respectively. Other sources combined make

up just over 4% of the total. Recent trends are showing less reliance on other sources of revenues and more on the sales and use and

property taxes.

5- 3

Ordinance No. 2432, Page 133 of 474