Page 78 - ClearGov | Documents

P. 78

revenue source and the absence of new hotel development , the City does not anticipate any signi{cant changes in hotel

tax revenue for the upcoming {scal year.

While Colleyville's local economy remains stable, the potential for growth in hotel tax revenue is limited due to the small

size of the hotel sector in the city. As a result , revenue estimates have been conser vatively projected for FY 2026 .

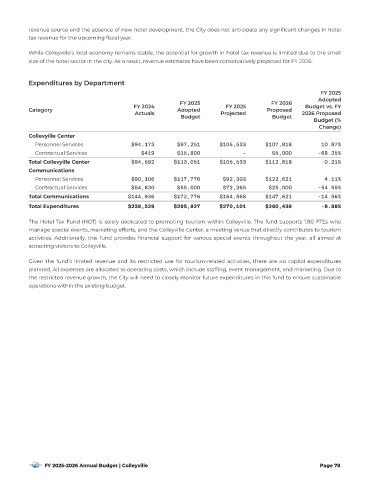

Expenditures by Depar tment

FY 2025

Adopted

FY 2025 FY 2026

FY 2024 FY 2025 Budget vs. FY

Category Adopted Proposed

Actuals Projected 2026 Proposed

Budget Budget

Budget (%

Change)

Collevyille Center

Personnel Ser vices $94,173 $97,251 $105,533 $107,818 10.87%

Contractual Ser vices $419 $15,800 - $5,000 -68.35%

Total Collevyille Center $94,592 $113,051 $105,533 $112,818 -0.21%

Communications

Personnel Ser vices $90,106 $117,776 $92,303 $122,621 4.11%

Contractual Ser vices $54,830 $55,000 $72,265 $25,000 -54.55%

Total Communications $144,936 $172,776 $164,568 $147,621 -14.56%

Total Expenditures $239,528 $285,827 $270,101 $260,439 -8.88%

The Hotel Tax Fund (HOT) is solely dedicated to promoting tourism within Colleyville. The fund suppor ts 1. 80 FTEs who

manage special events, marketing effor ts, and the Colleyville Center, a meeting venue that directly contributes to tourism

activities. Additionally, this fund provides {nancial suppor t for various special events throughout the year, all aimed at

attracting visitors to Colleyville.

Given the fund’s limited revenue and its restricted use for tourism-related activities, there are no capital expenditures

planned. All expenses are allocated to operating costs, which include staf{ng, event management , and marketing. Due to

the restricted revenue growth, the City will need to closely monitor future expenditures in this fund to ensure sustainable

operations within the existing budget .

FY 2025-2026 Annual Budget | Colleyville Page 78