Page 79 - ClearGov | Documents

P. 79

TIF Fund

The Colleyville Tax Increment Financing Reinvestment Zone Number One (TIF) is a discreetly presented component unit

of the City of Colleyville. The TIF is established as a governmental fund speci{cally designed to {nance public infrastructure

improvements and stimulate economic development within the designated reinvestment zone.

Although the TIF is not included in the City's main repor ting entity, it plays a crucial role in the broader picture of city

spending by allocating incremental proper ty tax revenues generated within the zone to fund necessary public

improvements. These improvements are aimed at attracting private investment , enhancing proper ty values, and fostering

long- term economic growth in the area.

The TIF is not considered a major fund, as its revenues and expenditures do not constitute more than 10% of the City ’s

appropriated budget . However, the information regarding the TIF is provided to offer a comprehensive view of the City's

overall {nancial activities and its commitment to economic development .

By reinvesting in the zone, the TIF suppor ts the City ’s strategic goals of improving infrastructure, promoting business

growth, and enhancing the quality of life for Colleyville residents.

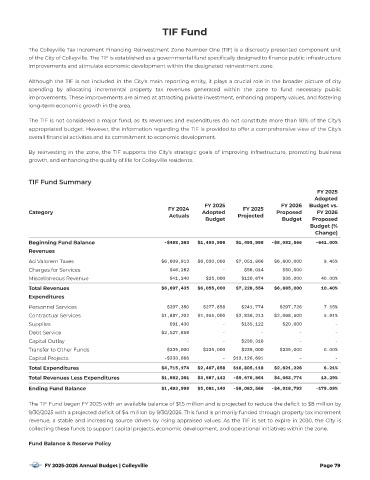

TIF Fund Summar y

FY 2025

Adopted

FY 2025 FY 2026 Budget vs.

FY 2024 FY 2025

Category Adopted Proposed FY 2026

Ac tuals Projec ted

Budget Budget Proposed

Budget (%

Change)

-$488,263 $1,493,998 $1,493,998 -$8,082,566 -641.00%

Beginning Fund Balance

Revenues

$6,609,913 $6,030,000 $7,051,866 $6,600,000 9.45%

Ad Valorem Taxes

$46,282 - $56,014 $50,000 -

Charges for Ser vices

$41,240 $25,000 $120,674 $35,000 40.00%

Miscellaneous Revenue

Total Revenues $6,697,435 $6,055,000 $7,228,554 $6,685,000 10.40%

Expenditures

$207,350 $277,858 $241,774 $297,726 7.15%

Personnel Ser vices

Contractual Ser vices $1,887,202 $1,955,000 $2,836,213 $2,068,500 5.81%

Supplies $91,430 - $135,122 $20,000 -

Debt Ser vice $2,527,858 - - - -

Capital Outlay - - $230,318 - -

Transfer to Other Funds $235,000 $235,000 $235,000 $235,000 0.00%

Capital Projects -$233,666 - $13,126,691 - -

$4,715,174 $2,467,858 $16,805,118 $2,621,226 6.21%

Total Expenditures

$1,982,261 $3,587,142 -$9,576,564 $4,063,774 13.29%

Total Revenues Less Expenditures

Ending Fund Balance $1,493,998 $5,081,140 -$8,082,566 -$4,018,792 -179.09%

The TIF Fund began FY 2025 with an available balance of $1.5 million and is projected to reduce the de{cit to $8 million by

9/30/2025 with a projected de{cit of $ 4 million by 9/30/2026 . This fund is primarily funded through proper ty tax increment

revenue, a stable and increasing source driven by rising appraised values. As the TIF is set to expire in 2030, the City is

collecting these funds to suppor t capital projects, economic development , and operational initiatives within the zone.

Fund Balance & Reser ve Policy

FY 2025-2026 Annual Budget | Colleyville Page 79