Page 47 - CityofWataugaAdoptedBudgetFY25

P. 47

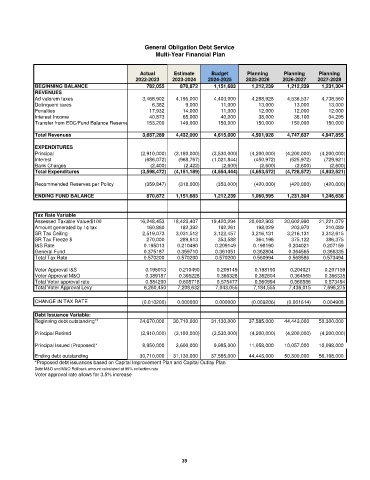

General Obligation Debt Service

Multi-Year Financial Plan

Actual Estimate Budget Planning Planning Planning

2022-2023 2023-2024 2024-2025 2025-2026 2026-2027 2027-2028

BEGINNING BALANCE 782,055 870,872 1,151,683 1,212,239 1,212,239 1,231,304

REVENUES

Ad valorem taxes 3,468,902 4,195,000 4,403,000 4,288,928 4,536,537 4,738,560

Delinquent taxes 6,382 9,000 11,000 13,000 13,000 13,000

Penalties 17,932 14,000 11,000 12,000 12,000 12,000

Interest Income 40,873 65,000 40,000 38,000 36,100 34,295

Transfer from EDC/Fund Balance Reserves 153,200 149,000 150,000 150,000 150,000 150,000

Total Revenues 3,687,289 4,432,000 4,615,000 4,501,928 4,747,637 4,947,855

EXPENDITURES

Principal (2,910,000) (3,180,000) (3,530,000) (4,200,000) (4,200,000) (4,200,000)

Interest (686,072) (968,767) (1,021,844) (450,972) (525,972) (729,921)

Bank Charges (2,400) (2,422) (2,600) (2,600) (2,600) (2,600)

Total Expenditures (3,598,472) (4,151,189) (4,554,444) (4,653,572) (4,728,572) (4,932,521)

Recommended Reserves per Policy (359,847) (318,000) (353,000) (420,000) (420,000) (420,000)

ENDING FUND BALANCE 870,872 1,151,683 1,212,239 1,060,595 1,231,304 1,246,638

Tax Rate Variable

Assessed Taxable Value/$100 16,248,453 18,423,407 19,420,294 20,002,903 20,602,990 21,221,079

Amount generated by 1¢ tax 160,860 182,392 192,261 198,029 203,970 210,089

SR Tax Ceiling 2,519,073 3,031,512 3,122,457 3,216,131 3,216,131 3,312,615

SR Tax Freeze $ 270,000 289,613 353,588 364,196 375,122 386,375

I&S Rate 0.195013 0.210490 0.209149 0.198190 0.204021 0.207159

General Fund 0.375187 0.359710 0.361051 0.362804 0.364565 0.366335

Total Tax Rate 0.570200 0.570200 0.570200 0.560994 0.568586 0.573494

Voter Approval I&S 0.195013 0.210490 0.209149 0.198190 0.204021 0.207159

Voter Approval M&O 0.389187 0.395228 0.366328 0.362804 0.364565 0.366335

Total Voter approval rate 0.584200 0.605718 0.575477 0.560994 0.568586 0.573494

Total Voter Approval Levy 6,260,450 7,208,632 7,043,055 7,184,555 7,436,015 7,696,275

CHANGE IN TAX RATE (0.010200) 0.000000 0.000000 (0.009206) (0.001614) 0.004908

Debt Issuance Variable:

Beginning debt outstanding** 24,670,000 30,710,000 31,130,000 37,585,000 44,443,000 50,300,000

Principal Retired (2,910,000) (3,180,000) (3,530,000) (4,200,000) (4,200,000) (4,200,000)

Principal Issued (Proposed)* 8,950,000 3,600,000 9,985,000 11,058,000 10,057,000 10,098,000

Ending debt outstanding 30,710,000 31,130,000 37,585,000 44,443,000 50,300,000 56,198,000

*Proposed debt issuances based on Capital Improvement Plan and Capital Outlay Plan

Debt M&O and M&O Rollback amount calculated at 99% collection rate

Voter approval rate allows for 3.5% increase

39