Page 46 - CityofWataugaAdoptedBudgetFY25

P. 46

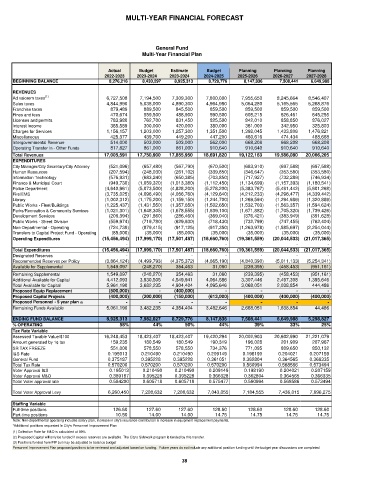

MULTI-YEAR FINANCIAL FORECAST

General Fund

Multi-Year Financial Plan

Actual Budget Estimate Budget Planning Planning Planning

2022-2023 2023-2024 2023-2024 2024-2025 2025-2026 2026-2027 2027-2028

BEGINNING BALANCE 8,276,216 8,430,297 8,925,313 8,729,776 8,147,836 7,508,441 6,649,988

REVENUES

Ad valorem taxes (1) 6,727,508 7,194,500 7,309,300 7,800,000 7,955,650 8,245,664 8,546,407

Sales taxes 4,844,990 5,038,000 4,890,300 4,964,980 5,064,280 5,165,565 5,268,876

Franchise taxes 879,489 889,500 845,500 859,500 859,500 859,500 859,500

Fines and fees 470,674 559,500 488,900 590,500 608,215 626,461 645,255

Licenses and permits 783,980 762,700 831,450 825,500 842,010 858,850 876,027

Interest Income 385,589 300,000 420,000 380,000 361,000 342,950 325,803

Charges for Services 1,156,157 1,203,000 1,257,300 1,351,500 1,392,045 1,433,806 1,476,821

Miscellaneous 425,377 439,700 449,200 447,200 460,616 474,434 488,668

Intergovernmental Revenue 514,000 503,000 503,000 562,000 668,208 668,208 668,208

Operating Transfer In - Other Funds 817,827 861,000 861,000 910,640 910,640 910,640 910,640

Total Revenues 17,005,591 17,750,900 17,855,950 18,691,820 19,122,163 19,586,080 20,066,205

EXPENDITURES

City Manager/City Secretary/City Attorney (521,096) (657,480) (567,790) (670,500) (683,910) (697,588) (697,588)

Human Resources (207,594) (248,030) (261,102) (339,850) (346,647) (353,580) (353,580)

Information Technology (576,931) (683,240) (650,385) (703,850) (717,927) (732,289) (746,934)

Finance & Municipal Court (949,730) (1,059,320) (1,013,380) (1,112,450) (1,134,699) (1,157,393) (1,180,541)

Police Department (4,640,961) (5,073,500) (4,828,200) (5,278,200) (5,383,767) (5,491,442) (5,601,268)

Fire/EMS (3,735,025) (4,096,490) (4,066,760) (4,129,640) (4,212,233) (4,296,477) (4,339,442)

Library (1,002,312) (1,175,200) (1,159,150) (1,244,700) (1,269,594) (1,294,986) (1,320,886)

Public Works - Fleet/Buildings (1,225,437) (1,431,550) (1,357,650) (1,502,650) (1,532,703) (1,563,357) (1,594,624)

Parks/Recreation & Community Services (1,021,301) (1,648,305) (1,678,555) (1,639,100) (1,671,882) (1,705,320) (1,739,426)

Development Services (206,394) (291,860) (286,460) (369,040) (376,421) (383,949) (391,628)

Public Works - Street Division (559,974) (719,780) (629,930) (718,430) (732,799) (747,455) (762,404)

Non-Departmental - Operating (724,739) (879,415) (917,125) (917,350) (1,263,978) (1,585,697) (2,254,044)

Transfers to Capital Project Fund - Operating (85,000) (35,000) (85,000) (35,000) (35,000) (35,000) (35,000)

Operating Expenditures (15,456,494) (17,999,170) (17,501,487) (18,660,760) (19,361,559) (20,044,533) (21,017,365)

- - - - - - -

Total Expenditures (15,456,494) (17,999,170) (17,501,487) (18,660,760) (19,361,559) (20,044,533) (21,017,365)

Designated Reserves - - - - - - -

Recommended Reserves per Policy (3,864,124) (4,499,793) (4,375,372) (4,665,190) (4,840,390) (5,011,133) (5,254,341)

Available for Supplemental 1,549,097 (248,270) 354,463 31,060 (239,395) (458,453) (951,161)

Remaining Supplemental 1,549,097 (248,270) 354,463 31,060 (239,395) (458,453) (951,161)

Additional Available for Capital 4,412,093 3,930,505 4,549,941 4,064,586 3,307,446 2,497,308 1,395,646

Total Available for Capital 5,961,190 3,682,235 4,904,404 4,095,646 3,068,051 2,038,854 444,486

Proposed Equip Replacement (500,000) - (400,000) - - - -

Proposed Capital Projects (400,000) (200,000) (150,000) (613,000) (400,000) (400,000) (400,000)

- - - - - - -

Proposed Personnel - 5 year plan (3)

Remaining Funds Available 5,061,190 3,482,235 4,354,404 3,482,646 2,668,051 1,638,854 44,486

ENDING FUND BALANCE 8,925,313 7,982,027 8,729,776 8,147,836 7,508,441 6,649,988 5,298,827

% OPERATING 58% 44% 50% 44% 39% 33% 25%

Tax Rate Variable

Assessed Taxable Value/$100 16,248,453 18,423,407 18,423,407 19,420,294 20,002,903 20,602,990 21,221,079

Amount generated by 1¢ tax 159,235 180,549 180,549 190,319 196,028 201,909 207,967

SR TAX FREEZE 551,000 578,550 578,550 734,376 771,095 809,650 850,132

I&S Rate 0.195013 0.210490 0.210490 0.209149 0.198190 0.204021 0.207159

General Fund 0.375187 0.395228 0.395228 0.361051 0.362804 0.364565 0.366335

Total Tax Rate 0.570200 0.570200 0.570200 0.570200 0.560994 0.568586 0.573494

Voter Approval I&S 0.195013 0.210490 0.210490 0.209149 0.198190 0.204021 0.207159

Voter Approval M&O 0.389187 0.395228 0.395228 0.366328 0.362804 0.364565 0.366335

Total Voter approval rate 0.584200 0.605718 0.605718 0.575477 0.560994 0.568586 0.573494

Total Voter Approval Levy 6,260,450 7,208,632 7,208,632 7,043,055 7,184,555 7,436,015 7,696,275

Staffing Variable

Full-time positions 126.60 127.60 127.60 128.60 128.60 128.60 128.60

Part-time positions 10.50 14.00 14.00 14.75 14.75 14.75 14.75

Note: Non-departmental operating includes salary plan, Increase in city's insurance contribution & increase in equipment replacement payments.

*Additional positions requested in City's Personnel Improvement Plan

(1) Collection Rate for M&O is calculated at 99%

(2) Proposed Capital will only be funded if excess reserves are available. The City's Sidewalk program is funded by this transfer.

(3) Positions funded from PIP but may be adjusted to balance budget

Personnel Improvement Plan proposed positions to be reviewed and adjusted based on funding. Future years do not include any additional position funding until the budget year discussions are completed.

38