Page 151 - CityofWataugaAdoptedBudgetFY25

P. 151

GENERAL FUND

The General Fund is a Governmental Fund, which means that it

is used to account for tax-supported activities that benefit all

citizens. The General Fund is used to account for all revenues

and expenditures not accounted for in other funds. It receives a greater variety of

taxes and other revenues and finances a wider range of governmental activities than

other funds. The fund is accounted for on the modified accrual basis of accounting.

Revenues are recorded when available and measurable and expenditures are

recorded when the liability is incurred.

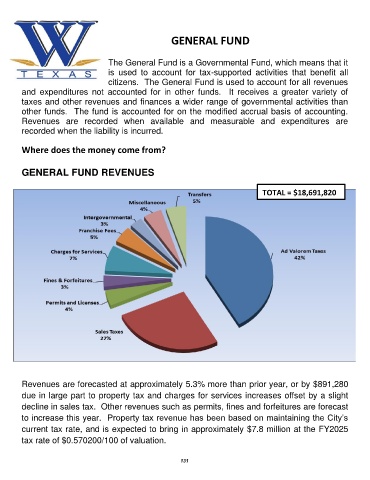

Where does the money come from?

GENERAL FUND REVENUES

TOTAL = $18,691,820

Revenues are forecasted at approximately 5.3% more than prior year, or by $891,280

due in large part to property tax and charges for services increases offset by a slight

decline in sales tax. Other revenues such as permits, fines and forfeitures are forecast

to increase this year. Property tax revenue has been based on maintaining the City’s

current tax rate, and is expected to bring in approximately $7.8 million at the FY2025

tax rate of $0.570200/100 of valuation.

131