Page 141 - CityofWataugaAdoptedBudgetFY25

P. 141

BUDGET SUMMARY

special revenue funds (Crime Control and Economic Development Fund). These are

projected at 5% of General Fund Revenues.

General Fund Expenditures

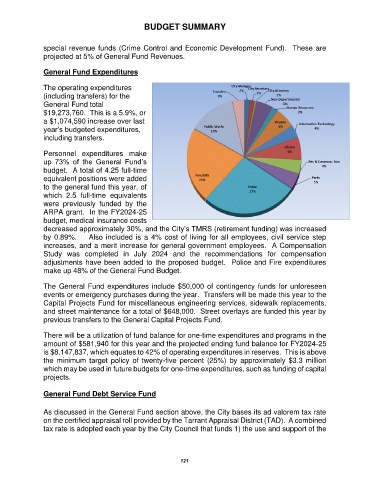

The operating expenditures

(including transfers) for the

General Fund total

$19,273,760. This is a 5.9%, or

a $1,074,590 increase over last

year’s budgeted expenditures,

including transfers.

Personnel expenditures make

up 73% of the General Fund’s

budget. A total of 4.25 full-time

equivalent positions were added

to the general fund this year, of

which 2.5 full-time equivalents

were previously funded by the

ARPA grant. In the FY2024-25

budget, medical insurance costs

decreased approximately 30%, and the City’s TMRS (retirement funding) was increased

by 0.89%. Also included is a 4% cost of living for all employees, civil service step

increases, and a merit increase for general government employees. A Compensation

Study was completed in July 2024 and the recommendations for compensation

adjustments have been added to the proposed budget. Police and Fire expenditures

make up 48% of the General Fund Budget.

The General Fund expenditures include $50,000 of contingency funds for unforeseen

events or emergency purchases during the year. Transfers will be made this year to the

Capital Projects Fund for miscellaneous engineering services, sidewalk replacements,

and street maintenance for a total of $648,000. Street overlays are funded this year by

previous transfers to the General Capital Projects Fund.

There will be a utilization of fund balance for one-time expenditures and programs in the

amount of $581,940 for this year and the projected ending fund balance for FY2024-25

is $8,147,837, which equates to 42% of operating expenditures in reserves. This is above

the minimum target policy of twenty-five percent (25%) by approximately $3.3 million

which may be used in future budgets for one-time expenditures, such as funding of capital

projects.

General Fund Debt Service Fund

As discussed in the General Fund section above, the City bases its ad valorem tax rate

on the certified appraisal roll provided by the Tarrant Appraisal District (TAD). A combined

tax rate is adopted each year by the City Council that funds 1) the use and support of the

121