Page 152 - CityofSouthlakeFY25AdoptedBudget

P. 152

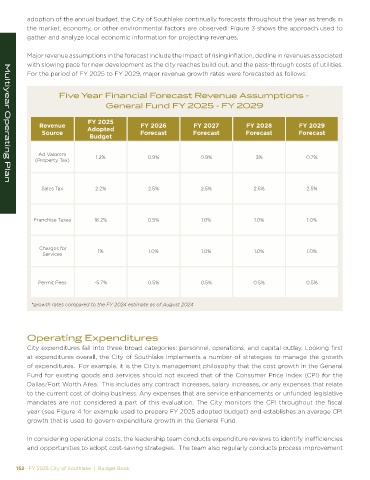

adoption of the annual budget, the City of Southlake continually forecasts throughout the year as trends in

the market, economy, or other environmental factors are observed. Figure 3 shows the approach used to

gather and analyze local economic information for projecting revenues.

Major revenue assumptions in the forecast include the impact of rising inflation, decline in revenues associated

with slowing pace for new development as the city reaches build out, and the pass-through costs of utilities.

For the period of FY 2025 to FY 2029, major revenue growth rates were forecasted as follows:

Five Year Financial Forecast Revenue Assumptions -

General Fund FY 2025 - FY 2029

FY 2025

Revenue Adopted FY 2026 FY 2027 FY 2028 FY 2029

Source Forecast Forecast Forecast Forecast

Budget

Ad Valorem 1.2% 0.9% 0.9% 3% 0.7%

(Property Tax)

Multiyear Operating Plan

Sales Tax 2.2% 2.5% 2.5% 2.5% 2.5%

Franchise Taxes 16.2% 0.5% 1.0% 1.0% 1.0%

Charges for 1% 1.0% 1.0% 1.0% 1.0%

Services

Permit Fees -5.7% 0.5% 0.5% 0.5% 0.5%

*growth rates compared to the FY 2024 estimate as of August 2024

Operating Expenditures

City expenditures fall into three broad categories: personnel, operations, and capital outlay. Looking first

at expenditures overall, the City of Southlake implements a number of strategies to manage the growth

of expenditures. For example, it is the City’s management philosophy that the cost growth in the General

Fund for existing goods and services should not exceed that of the Consumer Price Index (CPI) for the

Dallas/Fort Worth Area. This includes any contract increases, salary increases, or any expenses that relate

to the current cost of doing business. Any expenses that are service enhancements or unfunded legislative

mandates are not considered a part of this evaluation. The City monitors the CPI throughout the fiscal

year (see Figure 4 for example used to prepare FY 2025 adopted budget) and establishes an average CPI

growth that is used to govern expenditure growth in the General Fund.

In considering operational costs, the leadership team conducts expenditure reviews to identify inefficiencies

and opportunities to adopt cost-saving strategies. The team also regularly conducts process improvement

152 FY 2025 City of Southlake | Budget Book