Page 60 - CityofBurlesonFY25AdoptedBudget

P. 60

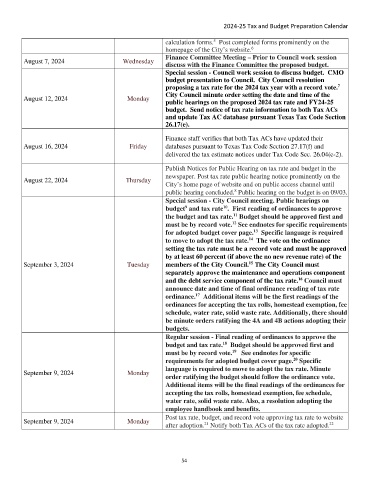

2024-25 Tax and Budget Preparation Calendar

5

calculation forms. Post completed forms prominently on the

6

homepage of the City’s website.

Finance Committee Meeting – Prior to Council work session

August 7, 2024 Wednesday

discuss with the Finance Committee the proposed budget.

Special session - Council work session to discuss budget. CMO

budget presentation to Council. City Council resolution

proposing a tax rate for the 2024 tax year with a record vote.

7

City Council minute order setting the date and time of the

August 12, 2024 Monday

public hearings on the proposed 2024 tax rate and FY24-25

budget. Send notice of tax rate information to both Tax ACs

and update Tax AC database pursuant Texas Tax Code Section

26.17(e).

Finance staff verifies that both Tax ACs have updated their

August 16, 2024 Friday databases pursuant to Texas Tax Code Section 27.17(f) and

delivered the tax estimate notices under Tax Code Sec. 26.04(e-2).

Publish Notices for Public Hearing on tax rate and budget in the

newspaper. Post tax rate public hearing notice prominently on the

August 22, 2024 Thursday

City’s home page of website and on public access channel until

8

public hearing concluded. Public hearing on the budget is on 09/03.

Special session - City Council meeting. Public hearings on

9

budget and tax rate . First reading of ordinances to approve

10

11

the budget and tax rate. Budget should be approved first and

must be by record vote. See endnotes for specific requirements

12

13

for adopted budget cover page. Specific language is required

14

to move to adopt the tax rate. The vote on the ordinance

setting the tax rate must be a record vote and must be approved

by at least 60 percent (if above the no new revenue rate) of the

September 3, 2024 Tuesday members of the City Council. The City Council must

15

separately approve the maintenance and operations component

16

and the debt service component of the tax rate. Council must

announce date and time of final ordinance reading of tax rate

17

ordinance. Additional items will be the first readings of the

ordinances for accepting the tax rolls, homestead exemption, fee

schedule, water rate, solid waste rate. Additionally, there should

be minute orders ratifying the 4A and 4B actions adopting their

budgets.

Regular session - Final reading of ordinances to approve the

18

budget and tax rate. Budget should be approved first and

must be by record vote. See endnotes for specific

19

20

requirements for adopted budget cover page. Specific

language is required to move to adopt the tax rate. Minute

September 9, 2024 Monday

order ratifying the budget should follow the ordinance vote.

Additional items will be the final readings of the ordinances for

accepting the tax rolls, homestead exemption, fee schedule,

water rate, solid waste rate. Also, a resolution adopting the

employee handbook and benefits.

Post tax rate, budget, and record vote approving tax rate to website

September 9, 2024 Monday

22

after adoption. Notify both Tax ACs of the tax rate adopted.

21

54