Page 59 - CityofBurlesonFY25AdoptedBudget

P. 59

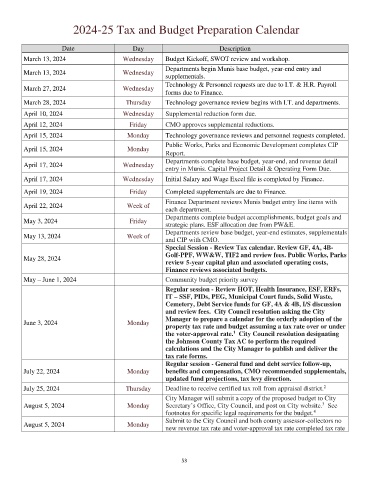

2024-25 Tax and Budget Preparation Calendar

Date Day Description

March 13, 2024 Wednesday Budget Kickoff, SWOT review and workshop.

Departments begin Munis base budget, year-end entry and

March 13, 2024 Wednesday

supplementals.

Technology & Personnel requests are due to I.T. & H.R. Payroll

March 27, 2024 Wednesday

forms due to Finance.

March 28, 2024 Thursday Technology governance review begins with I.T. and departments.

April 10, 2024 Wednesday Supplemental reduction form due.

April 12, 2024 Friday CMO approves supplemental reductions.

April 15, 2024 Monday Technology governance reviews and personnel requests completed.

Public Works, Parks and Economic Development completes CIP

April 15, 2024 Monday

Report.

Departments complete base budget, year-end, and revenue detail

April 17, 2024 Wednesday

entry in Munis. Capital Project Detail & Operating Form Due.

April 17, 2024 Wednesday Initial Salary and Wage Excel file is completed by Finance.

April 19, 2024 Friday Completed supplementals are due to Finance.

Finance Department reviews Munis budget entry line items with

April 22, 2024 Week of

each department.

Departments complete budget accomplishments, budget goals and

May 3, 2024 Friday

strategic plans. ESF allocation due from PW&E.

Departments review base budget, year-end estimates, supplementals

May 13, 2024 Week of

and CIP with CMO.

Special Session - Review Tax calendar. Review GF, 4A, 4B-

May 28, 2024 Golf-PPF, WW&W, TIF2 and review fees. Public Works, Parks

review 5-year capital plan and associated operating costs,

Finance reviews associated budgets.

May – June 1, 2024 Community budget priority survey

Regular session - Review HOT, Health Insurance, ESF, ERFs,

IT – SSF, PIDs, PEG, Municipal Court funds, Solid Waste,

Cemetery, Debt Service funds for GF, 4A & 4B, I/S discussion

and review fees. City Council resolution asking the City

Manager to prepare a calendar for the orderly adoption of the

June 3, 2024 Monday

property tax rate and budget assuming a tax rate over or under

1

the voter-approval rate. City Council resolution designating

the Johnson County Tax AC to perform the required

calculations and the City Manager to publish and deliver the

tax rate forms.

Regular session - General fund and debt service follow-up,

July 22, 2024 Monday benefits and compensation, CMO recommended supplementals,

updated fund projections, tax levy direction.

2

July 25, 2024 Thursday Deadline to receive certified tax roll from appraisal district.

City Manager will submit a copy of the proposed budget to City

3

August 5, 2024 Monday Secretary’s Office, City Council, and post on City website. See

4

footnotes for specific legal requirements for the budget.

Submit to the City Council and both county assessor-collectors no

August 5, 2024 Monday

new revenue tax rate and voter-approval tax rate completed tax rate

53