Page 486 - Bedford-FY24-25 Budget

P. 486

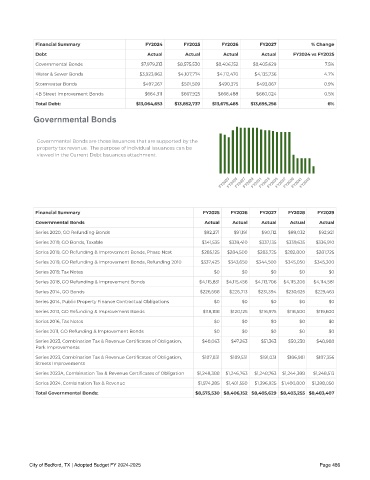

Financial Summar y FY2024 FY2025 FY2026 FY2027 % Change

Debt Ac tual Ac tual Ac tual Ac tual FY2024 vs FY2025

Governmental Bonds $7,979,213 $8,575,530 $8,406,152 $8,405,629 7.5%

Water & Sewer Bonds $3,923,862 $4,107,774 $4,112,470 $4,135,736 4.7%

Stormwater Bonds $497,267 $501,509 $490,375 $493,867 0.9%

4B Street Improvement Bonds $664,311 $667,925 $666,488 $660,024 0.5%

Total Debt: $13,064 ,653 $13, 852 ,737 $13,675,4 85 $13,695, 256 6%

Governmental Bonds

Governmental Bonds are those issuances that are supported by the

property tax revenue. The purpose of individual issuances can be

viewed in the Current Debt Issuances attachment.

FY2023 FY2025 FY2027 FY2029 FY2031 FY2033 FY2035 FY2037 FY2039 FY2041 FY2043

Financial Summar y FY2025 FY2026 FY2027 FY2028 FY2029

Governmental Bonds Ac tual Ac tual Ac tual Ac tual Ac tual

Series 2020, GO Refunding Bonds $92,271 $91,191 $90,112 $89,032 $92,921

Series 2019, GO Bonds, Taxable $341,535 $339,410 $337,135 $339,635 $336,910

Series 2019, GO Refunding & Improvement Bonds, Phase Next $285,125 $284,500 $283,725 $282,800 $281,725

Series 2019, GO Refunding & Improvement Bonds, Refunding 2010 $337,425 $343,650 $344,500 $345,050 $345,300

Series 2019, Tax Notes $0 $0 $0 $0 $0

Series 2018, GO Refunding & Improvement Bonds $4,115,831 $4,115,456 $4,113,706 $4,115,206 $4,114,581

Series 2014, GO Bonds $226,588 $226,713 $231,394 $230,625 $229,463

Series 2014, Public Property Finance Contractual Obligations $0 $0 $0 $0 $0

Series 2013, GO Refunding & Improvement Bonds $118,188 $120,125 $116,975 $118,500 $119,600

Series 2016, Tax Notes $0 $0 $0 $0 $0

Series 2011, GO Refunding & Improvement Bonds $0 $0 $0 $0 $0

Series 2023, Combination Tax & Revenue Certi cates of Obligation, $48,063 $47,263 $51,363 $50,238 $48,988

Park Improvements

Series 2023, Combination Tax & Revenue Certi cates of Obligation, $187,831 $189,531 $191,031 $186,981 $187,356

Streets Improvements

Series 2023A, Combination Tax & Revenue Certi cates of Obligation $1,248,388 $1,246,763 $1,248,763 $1,244,388 $1,248,513

Series 2024, Combination Tax & Revenue $1,574,285 $1,401,550 $1,396,925 $1,400,800 $1,398,050

Total Governmental Bonds: $8 ,575,530 $8 ,406 ,152 $8 ,405,629 $8 ,403, 255 $8 ,403,407

City of Bedford, TX | Adopted Budget FY 2024-2025 Page 486