Page 75 - CITY OF AZLE, TEXAS

P. 75

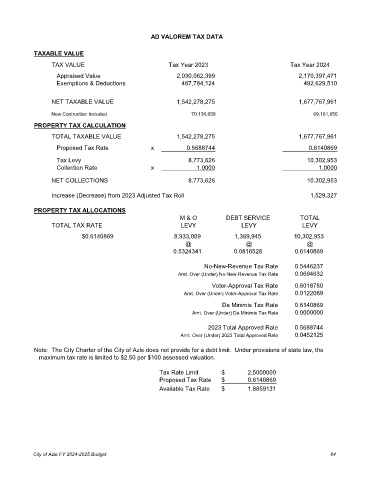

AD VALOREM TAX DATA

TAXABLE VALUE

TAX VALUE Tax Year 2023 Tax Year 2024

Appraised Value 2,030,062,399 2,170,397,471

Exemptions & Deductions 487,784,124 492,629,510

NET TAXABLE VALUE 1,542,278,275 1,677,767,961

New Contruction Included 70,136,659 69,161,050

PROPERTY TAX CALCULATION

TOTAL TAXABLE VALUE 1,542,278,275 1,677,767,961

Proposed Tax Rate x 0.5688744 0.6140869

Tax Levy 8,773,626 10,302,953

Collection Rate x 1.0000 1.0000

NET COLLECTIONS 8,773,626 10,302,953

Increase (Decrease) from 2023 Adjusted Tax Roll 1,529,327

PROPERTY TAX ALLOCATIONS

M & O DEBT SERVICE TOTAL

TOTAL TAX RATE LEVY LEVY LEVY

$0.6140869 8,933,009 1,369,945 10,302,953

@ @ @

0.5324341 0.0816528 0.6140869

No-New-Revenue Tax Rate 0.5446237

Amt. Over (Under) No-New-Revenue Tax Rate 0.0694632

Voter-Approval Tax Rate 0.6018780

Amt. Over (Under) Voter-Approval Tax Rate 0.0122089

De Minimis Tax Rate 0.6140869

Amt. Over (Under) De Minimis Tax Rate 0.0000000

2023 Total Approved Rate 0.5688744

Amt. Over (Under) 2023 Total Approved Rate 0.0452125

Note: The City Charter of the City of Azle does not provide for a debt limit. Under provisions of state law, the

maximum tax rate is limited to $2.50 per $100 assessed valuation.

Tax Rate Limit $ 2.5000000

Proposed Tax Rate $ 0.6140869

Available Tax Rate $ 1.8859131

City of Azle FY 2024-2025 Budget 64