Page 46 - CityofWataugaAdoptedBudgetFY24

P. 46

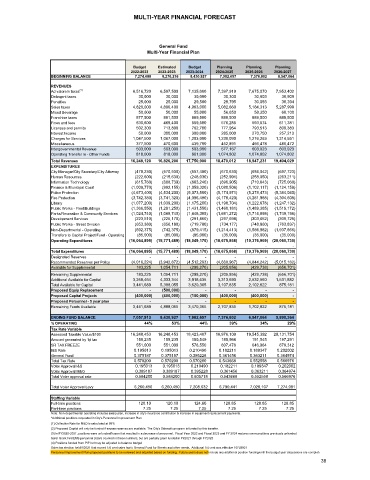

MULTI-YEAR FINANCIAL FORECAST

General Fund

Multi-Year Financial Plan

Budget Estimated Budget Planning Planning Planning

2022-2023 2022-2023 2023-2024 2024-2025 2025-2026 2026-2027

BEGINNING BALANCE 7,274,688 8,276,216 8,430,927 7,982,657 7,376,802 6,547,064

REVENUES

Ad valorem taxes (1) 6,516,720 6,597,500 7,135,000 7,397,919 7,675,070 7,953,402

Delinqent taxes 30,000 30,000 30,000 30,300 30,603 30,909

Penalties 25,000 25,000 29,500 29,795 30,093 30,394

Sales taxes 4,820,000 4,890,400 4,983,000 5,082,660 5,184,313 5,287,999

Mixed Beverage 50,000 50,000 55,000 56,650 58,350 60,100

Franchise taxes 877,500 891,500 889,500 889,500 889,500 889,500

Fines and fees 630,600 469,400 559,500 576,285 593,574 611,381

Licenses and permits 502,300 713,800 762,700 777,954 793,513 809,383

Interest Income 50,000 300,000 300,000 285,000 270,750 257,213

Charges for Services 1,047,500 1,067,000 1,203,000 1,239,090 1,276,263 1,314,551

Miscellaneous 377,500 470,600 439,700 452,891 466,478 480,472

Intergovernmental Revenue 503,000 503,000 503,000 577,167 603,923 603,923

Operating Transfer In - Other Funds 818,000 818,000 861,000 1,074,802 1,074,802 1,074,802

Total Revenues 16,248,120 16,826,200 17,750,900 18,470,012 18,947,231 19,404,029

EXPENDITURES

City Manager/City Secretary/City Attorney (478,230) (570,530) (657,480) (670,630) (684,042) (697,723)

Human Resources (222,600) (215,630) (248,030) (252,991) (258,050) (263,211)

Information Technology (615,760) (608,739) (683,240) (696,905) (710,843) (725,060)

Finance & Municipal Court (1,009,770) (992,155) (1,059,320) (1,080,506) (1,102,117) (1,124,159)

Police Protection (4,673,400) (4,534,200) (5,073,500) (5,174,971) (5,278,473) (5,384,040)

Fire Protection (3,742,380) (3,741,320) (4,096,490) (4,178,420) (4,261,988) (4,304,608)

Library (1,077,200) (1,039,200) (1,175,200) (1,198,704) (1,222,678) (1,247,132)

Public Works - Fleet/Buildings (1,366,550) (1,291,250) (1,431,550) (1,460,181) (1,489,385) (1,519,172)

Parks/Recreation & Community Services (1,024,740) (1,069,740) (1,648,305) (1,681,272) (1,714,898) (1,749,196)

Development Services (223,510) (225,170) (291,860) (297,698) (303,652) (309,725)

Public Works - Street Division (653,380) (656,180) (719,780) (734,177) (748,860) (763,837)

Non-Departmental - Operating (892,375) (742,375) (879,415) (1,214,413) (1,566,982) (1,937,866)

Transfers to Capital Project Fund - Operating (85,000) (85,000) (85,000) (35,000) (35,000) (35,000)

Operating Expenditures (16,064,895) (15,771,489) (18,049,170) (18,675,868) (19,376,969) (20,060,730)

- - - - - -

Total Expenditures (16,064,895) (15,771,489) (18,049,170) (18,675,868) (19,376,969) (20,060,730)

Designated Reserves - - - - - -

Recommended Reserves per Policy (4,016,224) (3,942,872) (4,512,293) (4,668,967) (4,844,242) (5,015,182)

Available for Supplemental 183,225 1,054,711 (298,270) (205,856) (429,738) (656,701)

Remaining Supplemental 183,225 1,054,711 (298,270) (205,856) (429,738) (656,701)

Additional Available for Capital 3,258,464 4,333,344 3,918,635 3,313,690 2,532,560 1,531,882

Total Available for Capital 3,441,689 5,388,055 3,620,365 3,107,835 2,102,822 875,181

Proposed Equip Replacement - (500,000) - - - -

Proposed Capital Projects (400,000) (400,000) (150,000) (400,000) (400,000) -

Proposed Personnel - 5 year plan - - - - - -

Remaining Funds Available 3,441,689 4,888,055 3,470,365 2,707,835 1,702,822 875,181

ENDING FUND BALANCE 7,057,913 8,430,927 7,982,657 7,376,802 6,547,064 5,890,364

% OPERATING 44% 53% 44% 39% 34% 29%

Tax Rate Variable

Assessed Taxable Value/$100 16,248,453 16,248,453 18,423,407 18,976,109 19,545,392 20,131,754

Amount generated by 1¢ tax 159,235 159,235 180,549 185,966 191,545 197,291

SR TAX FREEZE 551,000 551,000 578,550 607,478 646,964 679,312

I&S Rate 0.195013 0.195013 0.210490 0.182211 0.189347 0.202002

General Fund 0.375187 0.375187 0.395228 0.361456 0.363211 0.364974

Total Tax Rate 0.570200 0.570200 0.570200 0.543668 0.552558 0.566976

Voter Approval I&S 0.195013 0.195013 0.210490 0.182211 0.189347 0.202002

Voter Approval M&O 0.389187 0.389187 0.395228 0.361456 0.363211 0.364974

Total Voter approval rate 0.584200 0.584200 0.605718 0.543668 0.552558 0.566976

Total Voter Approval Levy 6,260,450 6,260,450 7,208,632 6,790,441 7,028,107 7,274,091

Staffing Variable

Full-time positions 120.10 120.10 124.60 128.85 128.85 128.85

Part-time positions 7.25 7.25 7.25 7.25 7.25 7.25

Note: Non-departmental operating includes salary plan, Increase in city's insurance contribution & increase in equipment replacement payments.

*Additional positions requested in City's Personnel Improvement Plan

(1) Collection Rate for M&O is calculated at 99%

(2) Proposed Capital will only be funded if excess reserves are available. The City's Sidewalk program is funded by this transfer.

(3) In FY2020-2021, positions were unfunded/frozen that resulted in a decrease of personnel. Fiscal Year 2022 and Fiscal 2023 and FY 2024 restores some positions previously unfunded.

Safer Grant Fire/EMS personnel (6)are counted in these numbers, but are partially grant funded in FY2021 through FY2023

(4) Positions funded from PIP but may be adjusted to balance budget

Sales tax election held 5/2021 that moved 1/4 cent sales tax to General Fund for Streets and other needs. Additonal 1/4 cent was effective 10/1/2021

Personnel Improvement Plan proposed positions to be reviewed and adjusted based on funding. Future years does not include any additional position funding until the budget year discussions are complete

38