Page 45 - CityofWataugaAdoptedBudgetFY24

P. 45

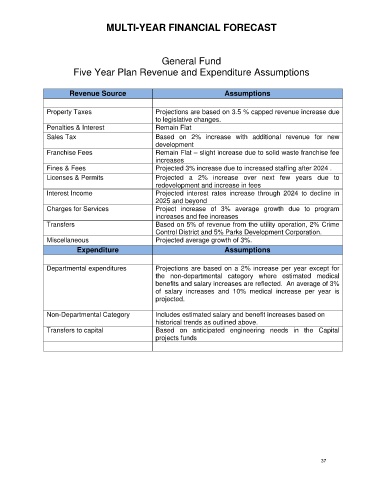

MULTI-YEAR FINANCIAL FORECAST

General Fund

Five Year Plan Revenue and Expenditure Assumptions

Revenue Source Assumptions

Property Taxes Projections are based on 3.5 % capped revenue increase due

to legislative changes.

Penalties & Interest Remain Flat

Sales Tax Based on 2% increase with additional revenue for new

development

Franchise Fees Remain Flat – slight increase due to solid waste franchise fee

increases

Fines & Fees Projected 3% increase due to increased staffing after 2024 .

Licenses & Permits Projected a 2% increase over next few years due to

redevelopment and increase in fees

Interest Income Projected interest rates increase through 2024 to decline in

2025 and beyond

Charges for Services Project increase of 3% average growth due to program

increases and fee increases

Transfers Based on 5% of revenue from the utility operation, 2% Crime

Control District and 5% Parks Development Corporation.

Miscellaneous Projected average growth of 3%.

Expenditure Assumptions

Departmental expenditures Projections are based on a 2% increase per year except for

the non-departmental category where estimated medical

benefits and salary increases are reflected. An average of 3%

of salary increases and 10% medical increase per year is

projected.

Non-Departmental Category Includes estimated salary and benefit increases based on

historical trends as outlined above.

Transfers to capital Based on anticipated engineering needs in the Capital

projects funds

37