Page 147 - GrapevineFY24 Adopted Budget

P. 147

Revenue and Other Financing Sources

Special Revenue funds are projected to generate $77.4 million in revenue for FY24, an increase of

$7.6 million (11%) from the previous year’s budget of $69.8 million. Revenue in the Convention &

Visitors fund, the largest of the category, is budgeted at $25.3 million and represents an increase of

$3 million from the previous budget year.

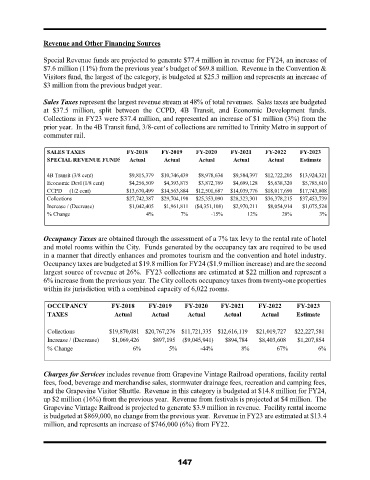

Sales Taxes represent the largest revenue stream at 48% of total revenues. Sales taxes are budgeted

at $37.5 million, split between the CCPD, 4B Transit, and Economic Development funds.

Collections in FY23 were $37.4 million, and represented an increase of $1 million (3%) from the

prior year. In the 4B Transit fund, 3/8-cent of collections are remitted to Trinity Metro in support of

commuter rail.

SALES TAXES FY-2018 FY-2019 FY-2020 FY-2021 FY-2022 FY-2023

SPECIAL REVENUE FUNDS Actual Actual Actual Actual Actual Estimate

4B Transit (3/8 cent) $9,815,379 $10,746,439 $8,978,634 $9,584,397 $12,722,205 $13,924,321

Economic Devl (1/8 cent) $4,256,509 $4,393,875 $3,872,769 $4,699,128 $5,638,320 $5,785,610

CCPD (1/2 cent) $13,670,499 $14,563,884 $12,501,687 $14,039,776 $18,017,690 $17,743,808

Collections $27,742,387 $29,704,198 $25,353,090 $28,323,301 $36,378,215 $37,453,739

Increase / (Decrease) $1,042,405 $1,961,811 ($4,351,108) $2,970,211 $8,054,914 $1,075,524

% Change 4% 7% -15% 12% 28% 3%

Occupancy Taxes are obtained through the assessment of a 7% tax levy to the rental rate of hotel

and motel rooms within the City. Funds generated by the occupancy tax are required to be used

in a manner that directly enhances and promotes tourism and the convention and hotel industry.

Occupancy taxes are budgeted at $19.8 million for FY24 ($1.9 million increase) and are the second

largest source of revenue at 26%. FY23 collections are estimated at $22 million and represent a

6% increase from the previous year. The City collects occupancy taxes from twenty-one properties

within its jurisdiction with a combined capacity of 6,022 rooms.

OCCUPANCY FY-2018 FY-2019 FY-2020 FY-2021 FY-2022 FY-2023

TAXES Actual Actual Actual Actual Actual Estimate

Collections $19,870,081 $20,767,276 $11,721,335 $12,616,119 $21,019,727 $22,227,581

Increase / (Decrease) $1,069,426 $897,195 ($9,045,941) $894,784 $8,403,608 $1,207,854

% Change 6% 5% -44% 8% 67% 6%

Charges for Services includes revenue from Grapevine Vintage Railroad operations, facility rental

fees, food, beverage and merchandise sales, stormwater drainage fees, recreation and camping fees,

and the Grapevine Visitor Shuttle. Revenue in this category is budgeted at $14.8 million for FY24,

up $2 million (16%) from the previous year. Revenue from festivals is projected at $4 million. The

Grapevine Vintage Railroad is projected to generate $3.9 million in revenue. Facility rental income

is budgeted at $869,000, no change from the previous year. Revenue in FY23 are estimated at $13.4

million, and represents an increase of $746,000 (6%) from FY22.

147