Page 35 - City of Fort Worth Budget Book

P. 35

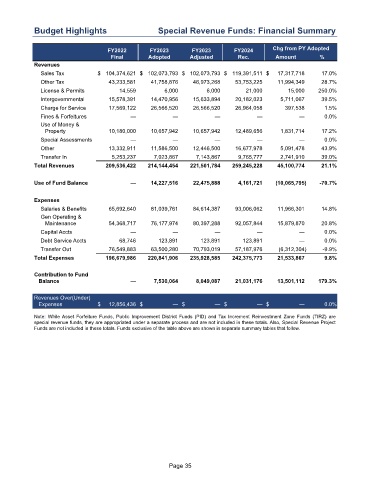

Budget Highlights Special Revenue Funds: Financial Summary

FY2022 FY2023 FY2023 FY2024 Chg from PY Adopted

Final Adopted Adjusted Rec. Amount %

Revenues

Sales Tax $ 104,374,621 $ 102,073,793 $ 102,073,793 $ 119,391,511 $ 17,317,718 17.0 %

Other Tax 43,233,581 41,758,876 46,973,268 53,753,225 11,994,349 28.7 %

License & Permits 14,559 6,000 6,000 21,000 15,000 250.0 %

Intergovernmental 15,578,391 14,470,956 15,633,894 20,182,023 5,711,067 39.5 %

Charge for Service 17,569,122 26,566,520 26,566,520 26,964,058 397,538 1.5 %

Fines & Forfeitures — — — — — 0.0 %

Use of Money &

Property 10,180,000 10,657,942 10,657,942 12,489,656 1,831,714 17.2 %

Special Assessments — — — — — 0.0 %

Other 13,332,911 11,586,500 12,446,500 16,677,978 5,091,478 43.9 %

Transfer In 5,253,237 7,023,867 7,143,867 9,765,777 2,741,910 39.0 %

Total Revenues 209,536,422 214,144,454 221,501,784 259,245,228 45,100,774 21.1 %

Use of Fund Balance — 14,227,516 22,475,888 4,161,721 (10,065,795) -70.7 %

Expenses

Salaries & Benefits 65,692,640 81,039,761 84,614,387 93,006,062 11,966,301 14.8 %

Gen Operating &

Maintenance 54,368,717 76,177,974 80,397,288 92,057,844 15,879,870 20.8 %

Capital Accts — — — — — 0.0 %

Debt Service Accts 68,746 123,891 123,891 123,891 — 0.0 %

Transfer Out 76,549,883 63,500,280 70,793,019 57,187,976 (6,312,304) -9.9 %

Total Expenses 196,679,986 220,841,906 235,928,585 242,375,773 21,533,867 9.8 %

Contribution to Fund

Balance — 7,530,064 8,049,087 21,031,176 13,501,112 179.3 %

Revenues Over(Under)

Expenses $ 12,856,436 $ — $ — $ — $ — 0.0 %

Note: While Asset Forfeiture Funds, Public Improvement District Funds (PID) and Tax Increment Reinvestment Zone Funds (TIRZ) are

special revenue funds, they are appropriated under a separate process and are not included in these totals. Also, Special Revenue Project

Funds are not included in these totals. Funds exclusive of the table above are shown in separate summary tables that follow.

Page 35