Page 30 - City of Fort Worth Budget Book

P. 30

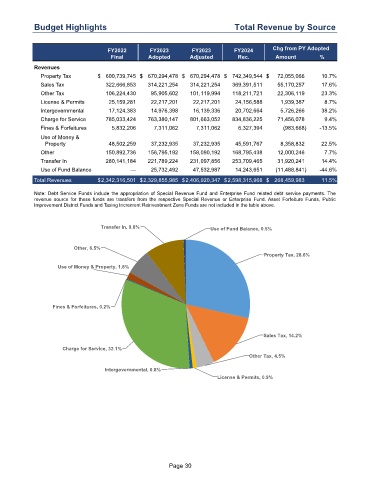

Budget Highlights Total Revenue by Source

FY2022 FY2023 FY2023 FY2024 Chg from PY Adopted

Final Adopted Adjusted Rec. Amount %

Revenues

Property Tax $ 600,739,745 $ 670,294,478 $ 670,294,478 $ 742,349,544 $ 72,055,066 10.7 %

Sales Tax 322,666,853 314,221,254 314,221,254 369,391,511 55,170,257 17.6 %

Other Tax 106,224,430 95,905,602 101,119,994 118,211,721 22,306,119 23.3 %

License & Permits 25,159,281 22,217,201 22,217,201 24,156,588 1,939,387 8.7 %

Intergovernmental 17,124,383 14,976,398 16,139,336 20,702,664 5,726,266 38.2 %

Charge for Service 785,033,424 763,380,147 801,663,052 834,836,225 71,456,078 9.4 %

Fines & Forfeitures 5,832,206 7,311,062 7,311,062 6,327,394 (983,668) -13.5 %

Use of Money &

Property 48,502,259 37,232,935 37,232,935 45,591,767 8,358,832 22.5 %

Other 150,892,736 156,795,192 158,090,192 168,795,438 12,000,246 7.7 %

Transfer In 280,141,184 221,789,224 231,097,856 253,709,465 31,920,241 14.4 %

Use of Fund Balance — 25,732,492 47,532,987 14,243,651 (11,488,841) -44.6 %

Total Revenues $ 2,342,316,501 $ 2,329,855,985 $ 2,406,920,347 $ 2,598,315,968 $ 268,459,983 11.5 %

Note: Debt Service Funds include the appropriation of Special Revenue Fund and Enterprise Fund related debt service payments. The

revenue source for these funds are transfers from the respective Special Revenue or Enterprise Fund. Asset Forfeiture Funds, Public

Improvement District Funds and Taxing Increment Reinvestment Zone Funds are not included in the table above.

Transfer In, 9.8% Use of Fund Balance, 0.5%

Other, 6.5%

Property Tax, 28.6%

Use of Money & Property, 1.8%

Fines & Forfeitures, 0.2%

Sales Tax, 14.2%

Charge for Service, 32.1%

Other Tax, 4.5%

Intergovernmental, 0.8%

License & Permits, 0.9%

Page 30