Page 34 - City of Fort Worth Budget Book

P. 34

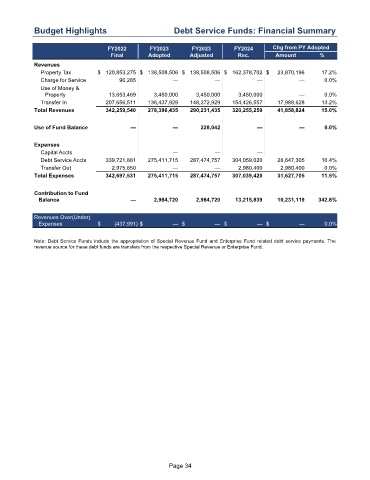

Budget Highlights Debt Service Funds: Financial Summary

FY2022 FY2023 FY2023 FY2024 Chg from PY Adopted

Final Adopted Adjusted Rec. Amount %

Revenues

Property Tax $ 120,853,275 $ 138,508,506 $ 138,508,506 $ 162,378,702 $ 23,870,196 17.2 %

Charge for Service 96,285 — — — — 0.0 %

Use of Money &

Property 13,653,469 3,450,000 3,450,000 3,450,000 — 0.0 %

Transfer In 207,656,511 136,437,929 148,272,929 154,426,557 17,988,628 13.2 %

Total Revenues 342,259,540 278,396,435 290,231,435 320,255,259 41,858,824 15.0 %

Use of Fund Balance — — 228,042 — — 0.0 %

Expenses

Capital Accts — — —

Debt Service Accts 339,721,881 275,411,715 287,474,757 304,059,020 28,647,305 10.4 %

Transfer Out 2,975,650 — — 2,980,400 2,980,400 0.0 %

Total Expenses 342,697,531 275,411,715 287,474,757 307,039,420 31,627,705 11.5 %

Contribution to Fund

Balance — 2,984,720 2,984,720 13,215,839 10,231,119 342.8 %

Revenues Over(Under)

Expenses $ (437,991) $ — $ — $ — $ — 0.0 %

Note: Debt Service Funds include the appropriation of Special Revenue Fund and Enterprise Fund related debt service payments. The

revenue source for these debt funds are transfers from the respective Special Revenue or Enterprise Fund.

Page 34