Page 36 - City of Fort Worth Budget Book

P. 36

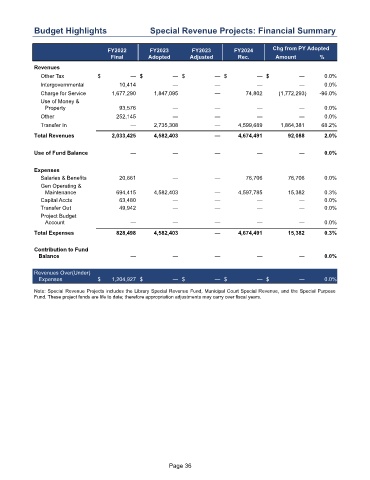

Budget Highlights Special Revenue Projects: Financial Summary

FY2022 FY2023 FY2023 FY2024 Chg from PY Adopted

Final Adopted Adjusted Rec. Amount %

Revenues

Other Tax $ — $ — $ — $ — $ — 0.0 %

Intergovernmental 10,414 — — — — 0.0 %

Charge for Service 1,677,290 1,847,095 — 74,802 (1,772,293) -96.0 %

Use of Money &

Property 93,576 — — — — 0.0 %

Other 252,145 — — — — 0.0 %

Transfer In — 2,735,308 — 4,599,689 1,864,381 68.2 %

Total Revenues 2,033,425 4,582,403 — 4,674,491 92,088 2.0 %

Use of Fund Balance — — — — — 0.0 %

Expenses

Salaries & Benefits 20,661 — — 76,706 76,706 0.0 %

Gen Operating &

Maintenance 694,415 4,582,403 — 4,597,785 15,382 0.3 %

Capital Accts 63,480 — — — — 0.0 %

Transfer Out 49,942 — — — — 0.0 %

Project Budget

Account — — — — — 0.0 %

Total Expenses 828,498 4,582,403 — 4,674,491 15,382 0.3 %

Contribution to Fund

Balance — — — — — 0.0 %

Revenues Over(Under)

Expenses $ 1,204,927 $ — $ — $ — $ — 0.0 %

Note: Special Revenue Projects includes the Library Special Revenue Fund, Municipal Court Special Revenue, and the Special Purpose

Fund. These project funds are life to date; therefore appropriation adjustments may carry over fiscal years.

Page 36