Page 72 - Watauga FY22-23 Budget

P. 72

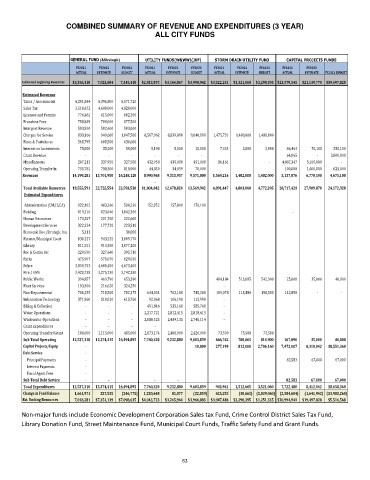

COMBINED SUMMARY OF REVENUE AND EXPENDITURES (3 YEAR)

ALL CITY FUNDS

GENERAL FUND (&Strategic) UTILITY FUNDS(W&WW)(JUF) STORM DRAIN UTILITY FUND CAPITAL PROJECTS FUNDS

FY2021 FY2022 FY2023 FY2021 FY2022 FY2023 FY2021 FY2022 FY2023 FY2021 FY2022

ACTUAL ESTIMATE BUDGET ACTUAL ESTIMATE BUDGET ACTUAL ESTIMATE BUDGET ACTUAL ESTIMATE FY2023 BUDGET

Estimated Beginning Resources $5,356,310 7,023,604 7,345,410 $2,813,075 $3,164,867 $3,998,942 $3,322,231 $3,321,060 $3,290,395 $23,579,545 $21,139,770 $19,497,828

Estimated Revenues

Taxes / Assessments 6,201,844 6,396,800 6,571,720

Sales Tax 3,518,672 4,680,000 4,820,000

Licenses and Permits 776,461 615,000 602,300

Franchise Fees 758,849 788,000 877,500

Intergovt Revenue 503,500 502,600 503,000

Charges for Service 833,166 949,600 1,047,500 8,507,962 8,839,898 9,040,000 1,475,731 1,480,000 1,480,000

Fines & Forfeitures 568,795 608,500 630,600 - -

Interest on Investments 75,000 35,200 50,000 5,198 5,000 10,000 7,324 2,000 2,000 86,464 70,100 250,100

Grant Revenue - - - - - - 64,065 - 3,800,000

Miscellaneous 207,213 337,950 327,500 432,958 435,000 451,000 86,161 - 4,887,347 5,100,000 -

Operating Transfer In 755,781 788,300 818,000 44,850 34,059 70,000 100,000 1,600,000 625,000

Total Current Year

Revenues 14,199,281 15,701,950 16,248,120 8,990,968 9,313,957 9,571,000 1,569,216 1,482,000 1,482,000 5,137,876 6,770,100 4,675,100

-

Total Available Resources 19,555,591 22,725,554 23,593,530 11,804,042 12,478,824 13,569,942 4,891,447 4,803,060 4,772,395 28,717,421 27,909,870 24,172,928

Estimated Expenditures

Administration (CM,CS,CA) 822,102 483,260 588,230 152,952 157,800 170,100

Building 819,210 823,040 1,042,300 -

Human Resources 174,207 221,760 222,600

Development Services 322,334 177,720 223,510

Economic Dev./Strategic Inn. 5,313 - 30,000

Finance/Municipal Court 830,227 943,525 1,009,770

Library 811,551 913,300 1,077,200

Rec & Comm Svc 229,590 327,640 395,710

Parks 475,907 570,070 629,030

Police 3,859,753 4,608,450 4,673,400

Fire / EMS 2,420,738 3,275,730 3,742,380

Public Works 394,857 469,790 653,380 484,184 513,685 542,900 25,000 35,000 40,000

Fleet Services 193,306 216,620 324,250 -

Non-Departmental 706,255 718,500 782,375 644,034 702,180 745,280 109,078 113,480 198,500 142,890 - -

Information Technology 371,960 510,010 615,760 92,068 106,190 112,990 -

Billing & Collection - - - 491,846 535,160 585,760 -

Water Operations - - - 2,217,721 2,812,415 2,818,615 -

Wastewater Operations - - - 2,088,525 2,439,135 2,745,114 -

Grant Expenditures - - - -

Operating Transfer/Grant 100,000 1,115,000 485,000 2,073,174 2,480,000 2,426,000 73,500 73,500 73,500

Sub Total Operating 12,537,310 15,374,415 16,494,895 7,760,320 9,232,880 9,603,859 666,762 700,665 814,900 167,890 35,000 40,000

Capital Projects/Equip - 10,000 277,199 812,000 2,706,160 7,472,007 8,310,042 18,551,360

Debt Service -

Principal Payments - 82,583 67,000 67,000

Interest Payments -

Fiscal Agent Fees -

Sub Total Debt Service - - - - 82,583 67,000 67,000

Total Expenditures 12,537,310 15,374,415 16,494,895 7,760,320 9,232,880 9,603,859 943,961 1,512,665 3,521,060 7,722,480 8,412,042 18,658,360

Change in Fund Balance 1,661,971 327,535 (246,775) 1,230,648 81,077 (32,859) 625,255 (30,665) (2,039,060) (2,584,604) (1,641,942) (13,983,260)

Est. Ending Resources 7,018,281 $7,351,139 $7,098,635 $4,043,723 $3,245,944 $3,966,083 $3,947,486 $3,290,395 $1,251,335 $20,994,941 $19,497,828 $5,514,568

Non-major funds include Economic Development Corporation Sales tax Fund, Crime Control District Sales Tax Fund,

Library Donation Fund, Street Maintenance Fund, Municipal Court Funds, Traffic Safety Fund and Grant Funds.

63