Page 69 - Watauga FY22-23 Budget

P. 69

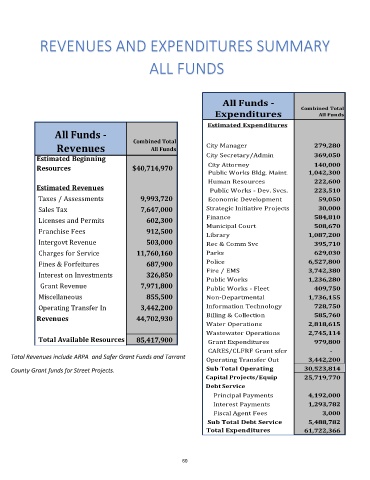

REVENUES AND EXPENDITURES SUMMARY

ALL FUNDS

All Funds -

Expenditures Combined Total

All Funds

Estimated Expenditures

All Funds -

Combined Total

Revenues All Funds City Manager 279,280

City Secretary/Admin 369,050

Estimated Beginning

Resources $40,714,970 City Attorney 140,000

Public Works Bldg. Maint. 1,042,300

Human Resources 222,600

Estimated Revenues

Public Works - Dev. Svcs. 223,510

Taxes / Assessments 9,993,720 Economic Development 59,050

Sales Tax 7,647,000 Strategic Initiative Projects 30,000

Licenses and Permits 602,300 Finance 584,810

Municipal Court 508,670

Franchise Fees 912,500

Library 1,087,200

Intergovt Revenue 503,000 Rec & Comm Svc 395,710

Charges for Service 11,760,160 Parks 629,030

Fines & Forfeitures 687,900 Police 6,527,800

Fire / EMS 3,742,380

Interest on Investments 326,850 Public Works 1,236,280

Grant Revenue 7,971,800

Public Works - Fleet 409,750

Miscellaneous 855,500 Non-Departmental 1,736,155

Operating Transfer In 3,442,200 Information Technology 728,750

Total Current Year

Revenues 44,702,930 Billing & Collection 585,760

Water Operations 2,818,615

Wastewater Operations 2,745,114

Total Available Resources 85,417,900

Grant Expenditures 979,800

CARES/CLFRF Grant xfer -

Total Revenues include ARPA and Safer Grant Funds and Tarrant Operating Transfer Out 3,442,200

County Grant funds for Street Projects. Sub Total Operating 30,523,814

Capital Projects/Equip 25,719,770

Debt Service

Principal Payments 4,192,000

Interest Payments 1,293,782

Fiscal Agent Fees 3,000

Sub Total Debt Service 5,488,782

Total Expenditures 61,722,366

60