Page 130 - Cover 3.psd

P. 130

ADOPTED | BUDGET

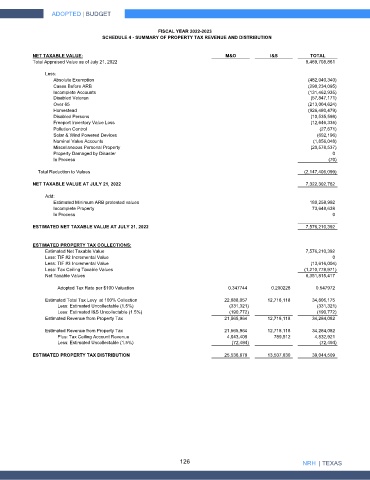

FISCAL YEAR 2022-2023

SCHEDULE 4 - SUMMARY OF PROPERTY TAX REVENUE AND DISTRIBUTION

NET TAXABLE VALUE: M&O I&S TOTAL

Total Appraised Value as of July 21, 2022 9,469,708,861

Less:

Absolute Exemption (482,040,340)

Cases Before ARB (290,234,095)

Incomplete Accounts (131,462,935)

Disabled Veteran (57,847,171)

Over 65 (213,004,624)

Homestead (926,480,479)

Disabled Persons (10,535,598)

Freeport Inventory Value Loss (12,646,335)

Pollution Control (27,671)

Solar & Wind Powered Devices (692,196)

Nominal Value Accounts (1,856,048)

Miscellaneous Personal Property (20,578,537)

Property Damaged by Disaster 0

In Process (70)

Total Reduction to Values (2,147,406,099)

NET TAXABLE VALUE AT JULY 21, 2022 7,322,302,762

Add:

Estimated Minimum ARB protested values 180,258,992

Incomplete Property 73,648,638

In Process 0

ESTIMATED NET TAXABLE VALUE AT JULY 21, 2022 7,576,210,392

ESTIMATED PROPERTY TAX COLLECTIONS:

Estimated Net Taxable Value 7,576,210,392

Less: TIF #2 Incremental Value 0

Less: TIF #3 Incremental Value (13,616,004)

Less: Tax Ceiling Taxable Values (1,210,778,971)

Net Taxable Values 6,351,815,417

Adopted Tax Rate per $100 Valuation 0.347744 0.200228 0.547972

Estimated Total Tax Levy at 100% Collection 22,088,057 12,718,118 34,806,175

Less: Estimated Uncollectable (1.5%) (331,321) (331,321)

Less: Estimated I&S Uncollectable (1.5%) (190,772) (190,772)

Estimated Revenue from Property Tax 21,565,964 12,718,118 34,284,082

Estimated Revenue from Property Tax 21,565,964 12,718,118 34,284,082

Plus: Tax Ceiling Account Revenue 4,043,409 789,512 4,832,921

Less: Estimated Uncollectable (1.5%) (72,494) (72,494)

ESTIMATED PROPERTY TAX DISTRIBUTION 25,536,879 13,507,630 39,044,509

126 NRH | TEXAS