Page 132 - Cover 3.psd

P. 132

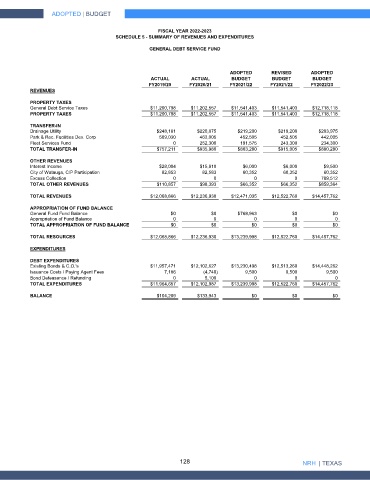

ADOPTED | BUDGET

FISCAL YEAR 2022-2023

SCHEDULE 5 - SUMMARY OF REVENUES AND EXPENDITURES

GENERAL DEBT SERVICE FUND

ADOPTED REVISED ADOPTED

ACTUAL ACTUAL BUDGET BUDGET BUDGET

FY2019/20 FY2020/21 FY2021/22 FY2021/22 FY2022/23

REVENUES

PROPERTY TAXES

General Debt Service Taxes $11,200,798 $11,202,557 $11,541,403 $11,541,403 $12,718,118

PROPERTY TAXES $11,200,798 $11,202,557 $11,541,403 $11,541,403 $12,718,118

TRANSFER-IN

Drainage Utility $248,181 $220,675 $219,200 $219,200 $203,975

Park & Rec. Facilities Dev. Corp 509,030 463,005 452,505 452,505 442,005

Fleet Services Fund 0 252,300 191,575 243,300 234,300

TOTAL TRANSFER-IN $757,211 $935,980 $863,280 $915,005 $880,280

OTHER REVENUES

Interest Income $28,004 $15,810 $6,000 $6,000 $9,500

City of Watauga, CIP Participation 82,853 82,583 60,352 60,352 60,352

Excess Collection 0 0 0 0 789,512

TOTAL OTHER REVENUES $110,857 $98,393 $66,352 $66,352 $859,364

TOTAL REVENUES $12,068,866 $12,236,930 $12,471,035 $12,522,760 $14,457,762

APPROPRIATION OF FUND BALANCE

General Fund Fund Balance $0 $0 $768,963 $0 $0

Appropriation of Fund Balance 0 0 0 0 0

TOTAL APPROPRIATION OF FUND BALANCE $0 $0 $0 $0 $0

TOTAL RESOURCES $12,068,866 $12,236,930 $13,239,998 $12,522,760 $14,457,762

EXPENDITURES

DEBT EXPENDITURES

Existing Bonds & C.O.'s $11,957,471 $12,102,627 $13,230,498 $12,513,260 $14,448,262

Issuance Costs / Paying Agent Fees 7,186 (4,740) 9,500 9,500 9,500

Bond Defeasance / Refunding 0 5,100 0 0 0

TOTAL EXPENDITURES $11,964,657 $12,102,987 $13,239,998 $12,522,760 $14,457,762

BALANCE $104,209 $133,943 $0 $0 $0

128 NRH | TEXAS