Page 135 - Cover 3.psd

P. 135

ADOPTED | BUDGET

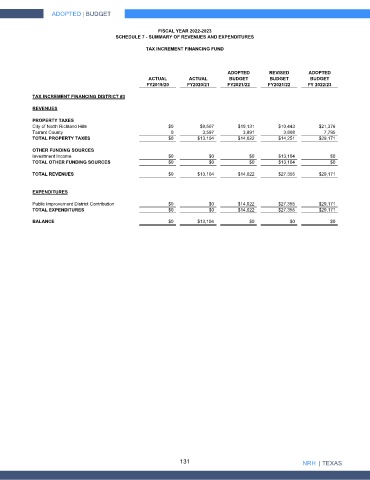

FISCAL YEAR 2022-2023

SCHEDULE 7 - SUMMARY OF REVENUES AND EXPENDITURES

TAX INCREMENT FINANCING FUND

ADOPTED REVISED ADOPTED

ACTUAL ACTUAL BUDGET BUDGET BUDGET

FY2019/20 FY2020/21 FY2021/22 FY2021/22 FY 2022/23

TAX INCREMENT FINANCING DISTRICT #3

REVENUES

PROPERTY TAXES

City of North Richland Hills $0 $9,507 $10,131 $10,443 $21,376

Tarrant County 0 3,597 3,891 3,808 7,795

TOTAL PROPERTY TAXES $0 $13,104 $14,022 $14,251 $29,171

OTHER FUNDING SOURCES

Investment Income $0 $0 $0 $13,104 $0

TOTAL OTHER FUNDING SOURCES $0 $0 $0 $13,104 $0

TOTAL REVENUES $0 $13,104 $14,022 $27,355 $29,171

EXPENDITURES

Public Improvement District Contribution $0 $0 $14,022 $27,355 $29,171

TOTAL EXPENDITURES $0 $0 $14,022 $27,355 $29,171

BALANCE $0 $13,104 $0 $0 $0

131 NRH | TEXAS