Page 48 - Lake Worth FY23 Adopted Budget Ord 1241

P. 48

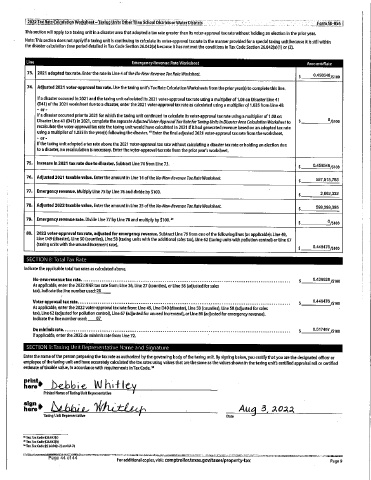

2O22_Tax RateCalculation Wo ksheet T- -- gaUnits- therThan School Districts orWater Districts Form5O=856 j

This section will apply to a taxing unit in a disaster area that adopted a taxrate greaterthan Its voter -approval tax rate without holding an election In the prior year.

Note: This section does not apply ifa taxing unit is continuing to calculate Its voter -approval tax rate In the manner provided for a special taxing unit because It Is still within

the disaster calculation time period detailed in Tax Code Section 26,042(a) because It has not met the conditions in Tax Code Section 26.042(a)( 1)' or (2).

EmergencyLine

Amount/ Rate

73. 2021 adopted tax rate. Enter the rate in Line 4 of the No -New -Revenue Tax Rate Worksheet

0.458548/$ 100

74. Adjusted 2021 voter -approval taxrate. Use the taxing unit's Tax Rate Calculation Worksheets from the prior year(s) to complete this line.

Ifa disaster occurred In 2021 and the taxing unit calculated Its 2021 voter -approval tax rate using a multiplier of1. 08 on Disaster Line 41

D41) ofthe 2021 worksheet due to a disaster, enter the 2021 voter -approval tax rate as calculated using a multiplier of 1. 035 from Line 49.

or -

Ifa disasteroccurred prior to 2021 for which the taxing unit continued to calculate Its voter -approval tax rate using a multiplier of 1.08 on

Disaster Line 41 ( D41) in 2021, complete the separate Adjusted Voter -Approval TaxRate forTaxing Units in DlsosterArea Calculation Worksheet to 0/$ 100

recalculate the voter -approval tax rate the taxing unit would have calculated In 2021 ifit had generated revenue based on an adopted tax rate

using a multiplier of 1. 035 in the year(s) following the disaster, 41 Enter the final adjusted 2021 voter -approval tax rate from the worksheet,

IN arm

Ifthetaxing unit adopted a tax rate above the 2021 voter -approval tax rate without calculating a disastertax rate or holding an election due

to a disaster, no recalculation Is necessary. Enter the voter -approval tax rate from the prior year's worksheet.

75, Increase In 2021 tax rate due to disaster, Subtract Line 74 from Line 73,

0.458548/$ 100

76. Adjusted 2021 taxable value. Enter the amount in Line 14 ofthe No -New -Revenue TaxRate Worksheet

5671515,785

77. Emergency revenue. Multiply Line 75 by Line 76 and divide by $100. 21602,332

78. Adjusted 2022 taxable value. Enter the amount in Line 25 ofthe No -New -Revenue TaxRate Worksheet. 599,399,395

79. Emergency revenue rate. Divide Line 77 by Line 78 and multiply by $100. 49

0/$ 100

80. 2022 voter -approval tax rate, adjusted for emergency revenue. Subtract Line 79 from one ofthe following lines (as applicable): Line 49,

Line D49 (disaster), Line 50 (counties), Line 58 (taxing units with the additional sales tax), Line 62 (taxing units with pollution control) or Line 67

taxing units with the unused Increment rate).

0.448476/$ 100

Indicate the applicable total tax rates as calculated above.

No -new -revenue tax rate. $ 0.438928 /$100

As applicable, enter the 2022 NNR tax rate from: Line 26, Line 27 (counties), or Llne 56 (adjusted for sales

tax). Indicate the line number used: 26

Voter -approval tax rate, a 0 a 5 a a a 0 9 4 0 4 a a a a 0 a a a a 0 4 0 6 0 0 6 a a a a a 0 0 9 9 0 a a 0 a 0.448476 /$100

a 6 a 0 0 0 0 0 0 6 0 0 a 0 a * 0 a 1 6 0 0 a a 0 D 0 a a 4 a 6 0 a 0 & a & a a 0 a 0 a 8 0 0 6 a a a a a 0 a 4 0 a 0 9 0 0 0 a a a a a 0 a a 0 $

As applicable, enter the 2022votar-approval tax rate from: Line 49, Line D49 (disaster), Line 50 (counties), Line 58 (adjusted for sales

tax), Line 62 (adjusted for pollution control), Line 67 (adjusted for unused Increment), or Line 80 (adjusted for emergency revenue).

Indicate the line number used: 67

Deminimis rate.... ... 0 a gas @too a 0 6 a ; ........................................... $ 0.517467 /$100

If applicable, enter the 2022 de minimis rate from Line 72.

Enter the name of the person preparing the tax rate as authorized by the governing body ofthe taxing unit. By signing below, you certify that you are the designated officer or

employee ofthe taxing unit and have accurately calculated the tax rates using values that are the same as the values shown (n the taxing unit's certified appraisal roll or certified

estimate of taxable value, in accordance with requirements InTax Code.

sorin

hereto abb 1 W h 1 i" V

1

Pdnted Name ofTaxing Unit Representa/

itive

SignI Au4a 3, q

here

Taxing Unit Representative Date

Tex. Tax Code 526.042(c)

Tex. Tax Code 426.042(b)

Tex, Tax Code 94 26.04(0) and (d•2)

Page 44 of I.

For additional copies, visit: comptrollertexas.gov/taxes/property-tax Page 9