Page 47 - Lake Worth FY23 Adopted Budget Ord 1241

P. 47

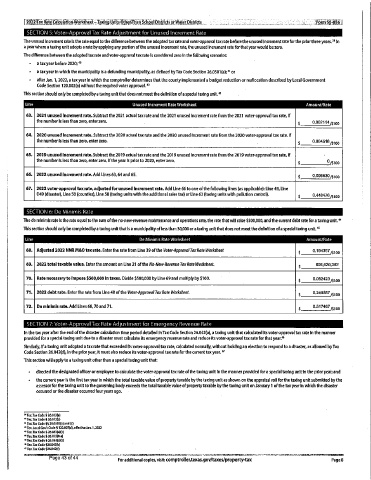

2022TaxRateC61cuathir Worksheet Tax(ng;llnitsOthef,ThahSchool Disfrl tsorWaterDistrids__ ;FoLro 0M56] The

unused Increment rate is the rate equal to the difference between the adopted tax rate and voter -approval tax rate before the unused Increment rate for the prior three years. "In a

year where a taxing unit adopts a rate by applying any portion of the unused Increment rate, the unused Increment rate for that year would be zero. The

difference between the adopted tax rate and voter -approval tax rate Is considered zero In the following scenarios: a

tax year before 2020;10 a

tax year In which the municipality Is a defunding municipality, as defined by Tax Code Section 26,0501(a); after

or

41

Jan.1, a tax year in which the comptroller determines that the county implemented a budget reduction or reallocation described by Local Government Code

20221

without

Section 120.002(a) the required voter approval." This

section should only be completed by a taxing unit that does not meet the definition of aspecial taxing unit." 63.

2021 unused Increment rate. Subtract the 2021 actual tax rate and the 2021 unused Increment rate from the 2021 voter -approval tax rate. If the

number is less than zero, enter zero. 0.

002114 /$ 100 64.

2020 unused Increment rate. Subtract the 2020 actual tax rate and the 2020 unused Increment rate from the 2020 voter -approval tax rate. If the

number is less than zero, enter zero. S

00004516/$ 100 65.

2019 unused Increment rate. Subtract the 2019 actual tax rate and the 2019 unused Increment rate from the 2019 voter -approval tax rate. If the

number is less than zero, enter zero. If the year is prior to 2020, enter zero. 0 / sloo 66.

2022 unused Increment rate. Add Lines 63,64 and 65. 0.

006630/ s100 67.

2022 voter -approval tax rate, adjusted for unused Increment rate. Add Line 66 to one of the following lines (as applicable): Line 49, Line D49 (

disaster), Line 50 (counties), Line 58 (taxing units with the additional sales tax) or Line 62 (taxing units with pollution control). 0. 448476/$ 100 The

Line minimis rate is the rate equal to the sum ofthe no -new -revenue maintenance and operations rate, the rate that will raise $500, 000, and the current debt rate for a taxing unit." This

section should only be completed by a taxing unit that is a municipality of less than 30,000 or a taxing unit that does not meet the definition of a special taxing unit.'s 68.

De Minimis Rate Worksheet Amount/ Rate de

0

Adjusted 2022 NNR M& tax rate. Enter the rate from Line 39 of theVoter -Approval Tax RateWorksheet 0.

194357 s100 69.

2022 total taxable value. Enter the amount on Line 21 of theNo -New -Revenue Tax Rate Worksheet. s 620,382 70.

606,

100.

Rate necessary to Impose $500, 000 in taxes. Divide $500, 000 by Line 69 and multiply by $s

0. 082423/$ 100 71.

2022 debt rate. Enter the rate from Line 48 of the Voter -Approval Tax Rate Worksheet s

0. 24o(i67 5100 72.

De minimis rate. Add Lines 68,70 and 71. 00517467

100 In

taxing

a

the tax year after the end of the disaster calculation time period detailed In Tax Code Section 26.042(a), unit that calculated Its voter -approval tax rate In the manner provided

for a special taxing unit due to a disaster must calculate Its emergency revenue rate and reduce Its voter -approval tax rate for that year!6 Similarly,

if a taxing unit adopted a tax rate that exceeded Its voter -approval tax rate, calculated normally, without holding an election to respond to a disaster, as allowed by Tax Code

the

in

Section 26.042(d), prior year, It must also reduce Its voter -approval tax rate for the current tax year. " This

section will apply to a taxing unit other than a special taxing unit that: directed

the designated officer or employee to calculate the voter -approval tax rate of thetaxing unit In the manner provided for a special taxing unit in the prior year; and the

current year Is the first tax year in which the total taxable value of property taxable by the taxing unit as shown on the appraisal roll for the taxing unit submitted by the assessor

for the taxing unit to the governing body exceeds the total taxable value of property taxable by the taxing unit on January 1 of the tax year In which the disaster occurred

or the disaster occurred four years ago, Tex.

Tex.

Tax fade 5 26. 013(a)

Tax Code 5 26.013(c)

Tex.

Tex.

and (

Tax Code SS 26.0501(a) c)

Local Gott Code 5120.007(d), Jan.1, Rx.

2022

eHedlve

Tex.

1)

Tax Code S 26. 063(a)(

Tax Code 5 26. 012(9•a) Tex.

I)

Tax Code S 26. 063(a)(Tex.

Tex.

Tax Code 526.042(b)

Tax Code 526.042(f )

Page

43 of 44 For

additional copies,visit: comptroller. texas.gov/taxes/ property- tax Page 6