Page 43 - Lake Worth FY23 Adopted Budget Ord 1241

P. 43

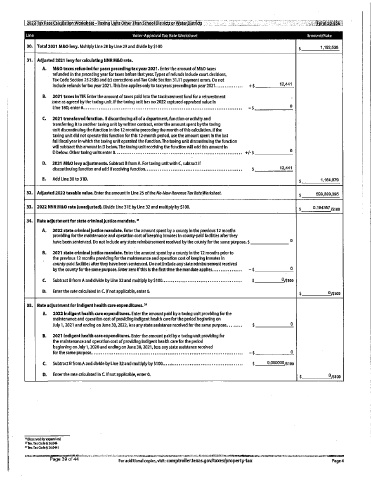

2022Tax Rat.. seal ilatlon'Worksheet Taxing'lJrJitsOthetjhanSchoolDlstrldsorWaterDlstricts _ ` Form50.=856'

Line VotermApproval Tax Rate Worksheet Amount/ Rate

30. Total 2021 M&O levy, Multiply Line 28 by Line 29 and divide by $100 1, 1623638

31. Adjusted 2021 levy for calculating NNR M& O rate.

A. M& O taxes refunded for years preceding tax year 2021. Enter the amount of M&O taxes

refunded in the preceding year for taxes before that year. Types of refunds Include court decisions,

Tax Code Section 25.25(b) and (c) corrections and Tax Code Section 31. 11 payment errors. Do not

12,441

include refunds for tax year 2021 aThis line applies only to tax years preceding tax year 2021............... + $

Be 2021 taxes In TIF. Enter the amount of taxes paid Into the tax Increment fund for a reinvestment

zone as agreed by the taxing unit. If the taxing unit has no 2022 captured appraised value In

0

Line18D, enter 0...................................................................................... a — $

C. 2021 transferred function. Ifdiscontinuing all ofa department, function or activity and

transferring it to another taxing unit by written contract, enter the amount spent by the taxing

unit discontinuing the function in the 12 months preceding the month ofthis calculation. If the

taxing unit did not operate this function for this 12-month period, use the amount spent In the last

full fiscal year in which the taxing unit operated the function.The taxing unit discontinuing the function

will subtract this amount In D below.The taxing unit receiving the function will add this amount In

0

Dbelow. Other taxing units enter 0..................... a............................................... +/ $

D. 2021 M& O levy adjustments. Subtract B from A. For taxing unit with C, subtract if

discontinuing function and add If receiving function.... .... so 9960oves 5 5 & age* @ ME@@ moffives some @fee& @ so * ON a 6 5 12,441

E. Add Line 30 to 31D. 19164,979

32. Adjusted 2022 taxable value. Enter the amount In Line 25 of the No -New -Revenue Tax Rate Worksheet 59%399,395

33. 2022 NNR M& O rate (unadjusted). Divide Line 31 E by Line 32 and multiply by $100. 0A94357 /$too

34. Rate adjustment for state criminal justice mandate."

A. 2022 state criminal justice mandate. Enter the amount spent by a county In the previous 12 months

providing for the maintenance and operation cost of keeping Inmates In county -paid facilities after they

0

have been sentenced. Do not Include any state reimbursement received by the county for the same purpose. $

Be 2021 state criminal justice mandate. Enter the amount spent by a county in the 12 months prior to

the previous 12 months providing for the maintenance and operation cost of keeping inmates In

county -paid facilities after they have been sentenced. Do not Include any state reimbursement received

4

by the county for the same purpose. Enter zero Ifthis Is the first time the mandate applies, . a 4 0 a $ 0

Co Subtract B from A and divide by Line 32 and multiply by$ 100............................................ $ 0/$100

D. Enter the rate calculated in C. If not applicable, enter 0.

0/$ 100

35. Rate adjustment for indigent healthcare expenditures."

A. 2022 Indigent health care expenditures. Enter the amount paid by a taxing unit providing for the

maintenance and operation cost ofproviding Indigent health care for the period beginning on

July 1, 2021 and ending on June 30, 2022, less any state assistance received for the same purpose......... $ 0

Be 2021 indigent health care expenditures, Enter the amount paid by a taxing unit providing for

the maintenance and operation cost of providing indigent health care for the period

beginning on July 1, 2020 and ending on June 30, 2021, less any state assistance received

forthe same purpose.. . I . 0 * a 0 a 0 a a a . 0 a 0 0 6 4 0 0 0 a a a 0 & 0 a 4 a 0 a a & 0 0 a 0 0 0 & a 4 0 0 a 9 a 0 0 a a 6 0 0 0 a 6 6 a a a & * a a 0 & a a & 0 4 6 * 8 0 9 0 a - $ 0

C. Subtract B fromA and divide by Line 32 and multiply by$ 100............................................ $ 0.000000/$ 100

D. Enter the rate calculated In C. If not applicable, enter 0.

0 $ too

Reserved for expansion)

Tex TaxCode42GW4

Tex.Tax Code 5 26.0441

Page 39 of44

Foradditionalcopies, visit: comptrollertexas.gov/taxes/ property-tax Page4