Page 46 - Lake Worth FY23 Adopted Budget Ord 1241

P. 46

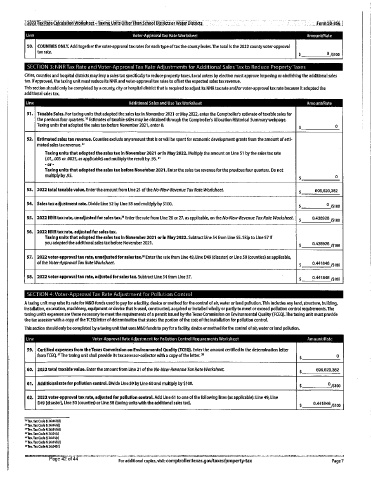

2022Tax Ra e_Calculatlotl,W& ksheet Pjaxing ,Units OtherThan School Distrlas orWater Districts , Form 50 856

50. COUNTIES ONLY. Add together the voter -approval tax rates for each type of tax the county Levies. The total is the 2022 county voter -approval

I tax rate. 0 / Stoo

Cltles, counties and hospital dlstricts.may levy a sales tax specifically to reduce property taxes. Local voters by election must approve Imposing or abolishing the additional sales

tax. Ifapproved, the taxing unit must reduce Its NNR and voter -approval tax rates to offset the expected sales tax revenue.

This section should only be completed by a county, city or hospital district that Is required to adjust Its NNR tax rate and/or voter -approval tax rate because It adopted the

additional sales tax,

e Adaitional hales and Ise lax Nork5heet Amount/ Rate

51. Taxable Sales. For taxing units that adopted the sales tax In November 2021 or May 2022, enter the Comptroller's estimate of taxable sales for

the previous four quarters. '= Estimates oftaxable sales may be obtained through the Comptroller's Allocation Historical Summary webpage.

Taxing units that adopted the sales tax before November 2021, enter 0. 0

52. Estimated sales tax revenue. Counties exclude any amount that is or will be spent for economic development grants from the amount of esti-

mated sales tax revenue."

Taxing units that adopted the sales tax in November 2021 or in May 2022, Multiply the amount on Line 51 by the sales tax rate

01, .005 or. 0025, as applicable) and multiply the result by. 95."

or-

Taxing units that adopted the sales tax before November 2021. Enter the sales tax revenue for the previous four quarters. Do not

multiply by .95. 0

53. 2022 total taxable value. Enter the amount from Line 21 of the No -New -Revenue Tax Rate Worksheet 6061620,382

54. Sales tax adjustment rate. Divide Line 52 by Line 53 and multiply by $100. 0 /$ loo

55. 2022 NNR tax rate, unadjusted for sales tax" Enter the rate from Line 26 or 27, as applicable, on the No -New -Revenue Tax Rate Worksheet.

00438928 /$ 100

56. 2022 NNR tax rate, adjusted for sales tax.

Taxing units that adopted the sales tax in November 2021 or In May 2022. Subtract Line 54 from Line 55. Skip to Line 571f

you adopted the additional sales tax before November 2021. 0.438928 /$ 100

57. 2022 voter -approval tax rate, unadjusted for sales tax.16 Enter the rate from Line 49, Line D49 (disaster) or Line 50 (counties) as applicable,

of the VoterApproval Tax Rate Worksheet

0.441846 /$too

5a. 2022 voter -approval tax rate, adjusted for sales tax. Subtract Line 54 from line 57,

0.441846 /$ 100

A taxing unit may raise Its rate for M&0 funds used to pay for a facility, device or method for the control ofair, water or land pollution. This Includes any land, structure, building,

installation, excavation, machinery, equipment or device that is used, constructed, acquired or Installed wholly or partly to meet or exceed pollution control requlrements.The

taxing unit's expenses are those necessary to meet the requirements of a permit Issued by the Texas Commission on Environmental Quality (TCEQ).The taxing unit must provide

the tax assessor with a copy of the TCEQ letter of determination that states the portion of the cost of the Installation for pollution control.

This section should only be completed by a taxing unit that uses M&O funds to pay for a facility, device or method for the control ofair, water or land pollution.

Line Voter -Approval Rate Adjustment for Pollution Control Requirements Worksheet AmountlRate

59. Certified expenses from the Texas Commission on Environmental Quality (TCEQ). Enter the amount certified In the determination letter

from TCEQ." The taxing unit shall provide Its tax assessor -collector with a copy of the letter." 0

60. 2022 total taxable value. Enter the amount from Line 21 of the No -New -Revenue Tax Rate Worksheet. 606,620,382

61. Additional rate for pollution control. Divide Line 59 by Line 60 and multiply by $100. 0 /Sim

62. 2022 voter -approval tax rate, adjusted for pollution control. Add Line 61 to one of the following lines (as applicable): Line 49, Line

D49 (disaster), Line 50 (counties) or Line 58 (taxing units with the additional sales tax). 0.441846 /$100

Tex.Tax Code 5 26.04I(d)

Tex.Tax Code 4 26.041( I)

Tex.Tax Cade 4 26.041(d)

u Tex. Taz Code 4 26.04Ic)

Tex.Tax Code 4 26.04(c)

Tex. Tax Code 4 26.045(d)

Tex.Tax Code 4 26.0450)

Page 42 of44

Foradditionalcopies,vislt: comptroller.texas.gov/taxes/property-tax Page7