Page 94 - HurstFY23AnnualBudget

P. 94

APPROVED BUDGET FISCAL YEAR 2022-2023

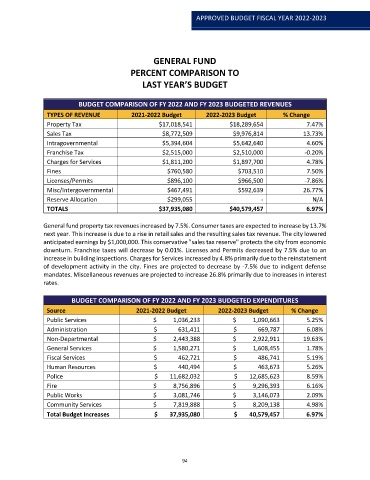

GENERAL FUND

PERCENT COMPARISON TO

LAST YEAR’S BUDGET

BUDGET COMPARISON OF FY 2022 AND FY 2023 BUDGETED REVENUES

TYPES OF REVENUE 2021-2022 Budget 2022-2023 Budget % Change

Property Tax $17,018,541 $18,289,654 7.47%

Sales Tax $8,772,509 $9,976,814 13.73%

Intragovernmental $5,394,604 $5,642,640 4.60%

Franchise Tax $2,515,000 $2,510,000 -0.20%

Charges for Services $1,811,200 $1,897,700 4.78%

Fines $760,580 $703,510 7.50%

Licenses/Permits $896,100 $966,500 -7.86%

Misc/Intergovernmental $467,491 $592,639 26.77%

Reserve Allocation $299,055 - N/A

TOTALS $37,935,080 $40,579,457 6.97%

General fund property tax revenues increased by 7.5%. Consumer taxes are expected to increase by 13.7%

next year. This increase is due to a rise in retail sales and the resulting sales tax revenue. The city lowered

anticipated earnings by $1,000,000. This conservative "sales tax reserve" protects the city from economic

downturn. Franchise taxes will decrease by 0.01%. Licenses and Permits decreased by 7.5% due to an

increase in building inspections. Charges for Services increased by 4.8% primarily due to the reinstatement

of development activity in the city. Fines are projected to decrease by -7.5% due to indigent defense

mandates. Miscellaneous revenues are projected to increase 26.8% primarily due to increases in interest

rates.

BUDGET COMPARISON OF FY 2022 AND FY 2023 BUDGETED EXPENDITURES

Source 2021-2022 Budget 2022-2023 Budget % Change

Public Services $ 1,036,233 $ 1,090,663 5.25%

Administration $ 631,411 $ 669,787 6.08%

Non-Departmental $ 2,443,388 $ 2,922,911 19.63%

General Services $ 1,580,271 $ 1,608,455 1.78%

Fiscal Services $ 462,721 $ 486,741 5.19%

Human Resources $ 440,494 $ 463,673 5.26%

Police $ 11,682,032 $ 12,685,623 8.59%

Fire $ 8,756,896 $ 9,296,393 6.16%

Public Works $ 3,081,746 $ 3,146,073 2.09%

Community Services $ 7,819,888 $ 8,209,138 4.98%

Total Budget Increases $ 37,935,080 $ 40,579,457 6.97%

94