Page 98 - HurstFY23AnnualBudget

P. 98

APPROVED BUDGET FISCAL YEAR 2022-2023

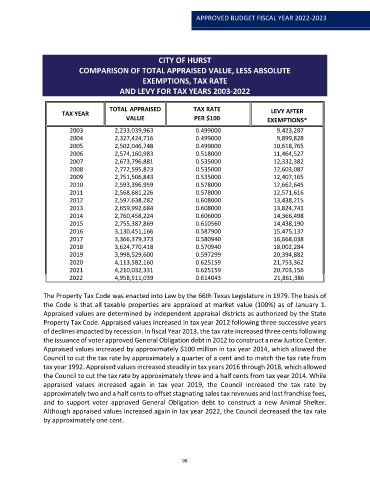

CITY OF HURST

COMPARISON OF TOTAL APPRAISED VALUE, LESS ABSOLUTE

EXEMPTIONS, TAX RATE

AND LEVY FOR TAX YEARS 2003-2022

TOTAL APPRAISED TAX RATE

TAX YEAR LEVY AFTER

VALUE PER $100 EXEMPTIONS*

2003 2,233,039,963 0.499000 9,423,287

2004 2,327,424,716 0.499000 9,899,828

2005 2,502,046,748 0.499000 10,618,765

2006 2,574,160,983 0.518000 11,464,527

2007 2,673,796,881 0.535000 12,332,382

2008 2,772,595,823 0.535000 12,603,087

2009 2,751,506,843 0.535000 12,407,165

2010 2,593,396,959 0.578000 12,662,645

2011 2,568,681,226 0.578000 12,571,616

2012 2,597,638,282 0.608000 13,438,215

2013 2,659,992,684 0.608000 13,824,741

2014 2,760,458,224 0.606000 14,366,498

2015 2,755,387,869 0.610560 14,438,190

2016 3,130,451,166 0.587900 15,475,137

2017 3,366,379,373 0.580940 16,668,038

2018 3,624,770,418 0.570940 18,002,284

2019 3,998,529,600 0.597299 20,394,882

2020 4,113,582,160 0.625159 21,753,362

2021 4,210,032,331 0.625159 20,703,156

2022 4,958,511,039 0.614043 21,861,386

The Property Tax Code was enacted into Law by the 66th Texas Legislature in 1979. The basis of

the Code is that all taxable properties are appraised at market value (100%) as of January 1.

Appraised values are determined by independent appraisal districts as authorized by the State

Property Tax Code. Appraised values increased in tax year 2012 following three successive years

of declines impacted by recession. In fiscal Year 2013, the tax rate increased three cents following

the issuance of voter approved General Obligation debt in 2012 to construct a new Justice Center.

Appraised values increased by approximately $100 million in tax year 2014, which allowed the

Council to cut the tax rate by approximately a quarter of a cent and to match the tax rate from

tax year 1992. Appraised values increased steadily in tax years 2016 through 2018, which allowed

the Council to cut the tax rate by approximately three and a half cents from tax year 2014. While

appraised values increased again in tax year 2019, the Council increased the tax rate by

approximately two and a half cents to offset stagnating sales tax revenues and lost franchise fees,

and to support voter approved General Obligation debt to construct a new Animal Shelter.

Although appraised values increased again in tax year 2022, the Council decreased the tax rate

by approximately one cent.

98