Page 99 - HurstFY23AnnualBudget

P. 99

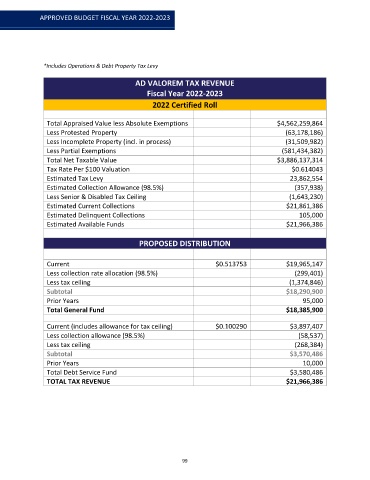

APPROVED BUDGET FISCAL YEAR 2022-2023

*Includes Operations & Debt Property Tax Levy

AD VALOREM TAX REVENUE

Fiscal Year 2022-2023

2022 Certified Roll

Total Appraised Value less Absolute Exemptions $4,562,259,864

Less Protested Property (63,178,186)

Less Incomplete Property (incl. in process) (31,509,982)

Less Partial Exemptions (581,434,382)

Total Net Taxable Value $3,886,137,314

Tax Rate Per $100 Valuation $0.614043

Estimated Tax Levy 23,862,554

Estimated Collection Allowance (98.5%) (357,938)

Less Senior & Disabled Tax Ceiling (1,643,230)

Estimated Current Collections $21,861,386

Estimated Delinquent Collections 105,000

Estimated Available Funds $21,966,386

PROPOSED DISTRIBUTION

Current $0.513753 $19,965,147

Less collection rate allocation (98.5%) (299,401)

Less tax ceiling (1,374,846)

Subtotal $18,290,900

Prior Years 95,000

Total General Fund $18,385,900

Current (includes allowance for tax ceiling) $0.100290 $3,897,407

Less collection allowance (98.5%) (58,537)

Less tax ceiling (268,384)

Subtotal $3,570,486

Prior Years 10,000

Total Debt Service Fund $3,580,486

TOTAL TAX REVENUE $21,966,386

99