Page 326 - HurstFY23AnnualBudget

P. 326

APPROVED BUDGET FISCAL YEAR 2022-2023

Other Self-Supporting Debt

The capital improvements section of this document details various debt instruments the City may

consider issuing to fund improvements. While these are debt instruments the City may consider

all outstanding is either General Obligation (GO) debt exclusively supported by the debt portion

of the tax rate or Combination Tax & Revenue Certificates of Obligation (CO) that are self-

supporting through other revenues yet have a limited pledge of property tax revenue to secure

the debt. All outstanding debt is secured by property taxes and the City holds no pure revenue

backed debt. As such, there are no debt coverage requirements due to property taxes being used

to secure all outstanding debt. While there are no debt coverage requirements, the City does

hold a portion of reserves in the Enterprise Fund and the Hotel/Motel Fund as a contingency for

debt service obligations. Combination Tax & Revenue CO’s will call upon the property tax

revenue pledge only when revenues are insufficient.

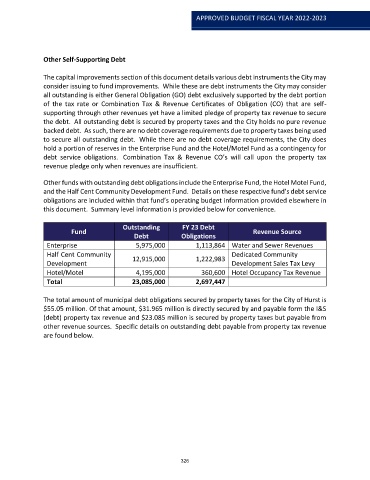

Other funds with outstanding debt obligations include the Enterprise Fund, the Hotel Motel Fund,

and the Half Cent Community Development Fund. Details on these respective fund’s debt service

obligations are included within that fund’s operating budget information provided elsewhere in

this document. Summary level information is provided below for convenience.

Outstanding FY 23 Debt

Fund Revenue Source

Debt Obligations

Enterprise 5,975,000 1,113,864 Water and Sewer Revenues

Half Cent Community 12,915,000 1,222,983 Dedicated Community

Development Development Sales Tax Levy

Hotel/Motel 4,195,000 360,600 Hotel Occupancy Tax Revenue

Total 23,085,000 2,697,447

The total amount of municipal debt obligations secured by property taxes for the City of Hurst is

$55.05 million. Of that amount, $31.965 million is directly secured by and payable form the I&S

(debt) property tax revenue and $23.085 million is secured by property taxes but payable from

other revenue sources. Specific details on outstanding debt payable from property tax revenue

are found below.

326