Page 75 - Grapevine FY23 Adopted Budget (1)

P. 75

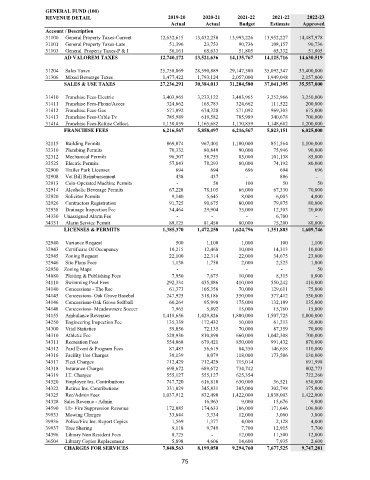

GENERAL FUND (100)

REVENUE DETAIL 2019-20 2020-21 2021-22 2021-22 2022-23

Actual Actual Budget Estimate Approved

Account / Description

31100 General Property Taxes-Current 12,632,615 13,432,250 13,993,226 13,952,227 14,487,978

31101 General Property Taxes-Late 51,396 23,753 90,736 108,157 90,736

31103 General Property Taxes-P & I 56,161 65,633 51,805 65,332 51,805

AD VALOREM TAXES 12,740,172 13,521,636 14,135,767 14,125,716 14,630,519

31204 Sales Taxes 25,758,869 28,590,889 29,147,580 35,092,347 33,400,000

31306 Mixed Beverage Taxes 1,477,422 1,793,124 2,057,000 1,949,048 2,157,000

SALES & USE TAXES 27,236,291 30,384,013 31,204,580 37,041,395 35,557,000

31410 Franchise Fees-Electric 3,403,965 3,233,122 3,403,965 3,252,966 3,250,000

31411 Franchise Fees-Phone/Acces 324,662 165,783 324,662 111,522 200,000

31412 Franchise Fees-Gas 571,092 674,328 571,092 969,303 675,000

31413 Franchise Fees-Cable Tv 785,989 619,582 785,989 340,678 700,000

31414 Franchise Fees-Refuse Collect. 1,130,859 1,165,682 1,130,859 1,148,682 1,200,000

FRANCHISE FEES 6,216,567 5,858,497 6,216,567 5,823,151 6,025,000

32115 Building Permits 869,074 967,401 1,100,000 851,564 1,100,000

32310 Plumbing Permits 70,332 80,849 90,000 75,946 90,000

32312 Mechanical Permits 96,307 58,755 85,000 101,138 85,000

32525 Electric Permits 57,843 78,293 80,000 74,192 80,000

32900 Trailer Park Licenses 694 694 696 694 696

32908 Vet Bill Reimbursement 438 437 - 886 -

32913 Coin-Operated Machine Permits - 50 100 50 50

32914 Alcoholic Beverage Permits 67,228 78,105 66,000 67,330 70,000

32920 Solicitor Permits 9,140 5,645 8,000 6,005 4,000

32926 Contractors Registration 91,725 90,675 80,000 79,875 80,000

32938 Drainage Inspection Fee 34,464 29,904 35,000 12,303 20,000

34330 Unassigned Alarm Fee - - - 6,700 -

34331 Alarm Service Permit 88,125 81,450 80,000 75,200 80,000

LICENSES & PERMITS 1,385,370 1,472,258 1,624,796 1,351,883 1,609,746

32940 Variance Request 500 1,100 1,000 100 1,100

32943 Certificate Of Occupancy 10,215 12,468 10,000 14,313 10,000

32945 Zoning Request 22,100 22,314 22,000 34,675 23,000

32946 Site Plans Fees 1,138 1,750 2,000 2,525 1,800

32950 Zoning Maps - - - - 50

34080 Platting & Publishing Fees 7,950 7,675 10,000 8,315 8,000

34110 Swimming Pool Fees 292,334 435,886 410,000 550,242 410,000

34140 Concessions - The Rec 61,373 105,358 70,000 129,611 75,000

34145 Concessions- Oak Grove Basebal 247,925 318,186 350,000 377,412 350,000

34146 Concessions-Oak Grove Softball 60,264 95,998 175,000 132,189 135,000

34148 Concessions- Meadowmere Soccer 7,965 5,892 15,000 15,760 15,000

34155 Ambulance Revenues 1,418,656 1,429,826 1,800,000 1,507,725 1,800,000

34250 Engineering Inspection Fee 135,339 172,432 50,000 61,213 50,000

34300 Vital Statistics 59,056 72,135 70,000 87,359 70,000

34310 Athletic Fee 528,930 810,890 660,000 1,042,308 700,000

34311 Recreation Fees 554,068 679,421 850,000 991,432 870,000

34312 Pard Event & Program Fees 87,483 56,619 84,350 146,658 110,000

34316 Facility Use Charges 39,139 8,079 118,000 173,506 130,000

34317 Fleet Charges 712,429 712,429 715,014 891,998

34318 Insurance Charges 698,672 689,672 734,742 802,773

34319 I.T. Charges 555,127 555,127 625,354 722,260

34320 Employee Ins. Contributions 747,720 616,810 630,000 36,521 630,000

34322 Retiree Ins. Contributions 331,029 345,831 305,000 302,798 375,000

34325 Rec/Admin Fees 1,037,912 832,490 1,422,000 1,838,003 1,422,000

34328 Sales Revenue - Admin - 16,963 9,000 15,676 9,000

34590 Ub- Fire Suppression Revenue 172,085 174,633 106,000 171,646 106,000

39933 Mowing Charges 33,844 3,334 12,000 3,060 3,000

39936 Police/Fire Ins. Report Copies 1,569 1,377 4,000 2,128 4,000

39937 Tree Sharing 9,118 9,749 7,700 12,915 7,700

34396 Library Non Resident Fees 8,725 - 12,000 11,500 12,000

36504 Library Copier Replacement 5,898 4,606 14,600 7,935 2,600

CHARGES FOR SERVICES 7,848,563 8,199,050 9,294,760 7,677,525 9,747,281

75