Page 130 - City of Watauga FY22 Adopted Budget

P. 130

BUDGET-OVERVIEW

up from $936.39 last year. This represents a monthly cost of $84.08, or $6.64/day for the

City to provide services such as the day to day operations of the City including 24-hour

police, fire and EMS Service, public works, parks and recreation, library services, building

inspections, code compliance and other essential City services.

The City is landlocked and approximately 96% built out, however, in the City and

surrounding area, there has been substantial growth in residential and commercial

property valuations over the last several years. The Emerging Trends in Real Estate

for 2020 report from Price Waterhouse Coopers and the Urban Land Institute ranked

the Metroplex as the number four market for overall real estate prospects in 2020 out of

80 other cities.

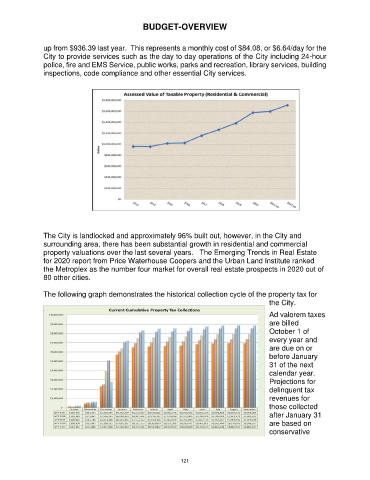

The following graph demonstrates the historical collection cycle of the property tax for

the City.

Ad valorem taxes

are billed

October 1 of

every year and

are due on or

before January

31 of the next

calendar year.

Projections for

delinquent tax

revenues for

those collected

after January 31

are based on

conservative

121