Page 134 - City of Watauga FY22 Adopted Budget

P. 134

BUDGET-OVERVIEW

was near full staffing and there was an increase in code, traffic enforcement, and warrant

collection efforts, thus increasing citations issued over prior year. FY2021-2022 budget

revenues for this category was increased by 9.5% to reflect FY2020-21 actuals due to the

increase in citations. Fines and forfeitures make up approximately 4% of General Fund

revenues for FY2022.

Miscellaneous revenue – This includes interest earned on the investment of General

Fund cash, proceeds from the sale of surplus City property, cell phone tower rent

revenues and other various revenues. Interest earnings are expected to be remain low

in FY2021-2022 due to the Federal Reserve holding interest rates near zero.

Transfers In – Transfers in are comprised of funds transferred from another fund for

general and administrative fees or obligations that the General Fund provides. The

contributing funds include the proprietary funds (Water and Sewer, Storm Drain) and

special revenue funds (Crime Control and Economic Development Fund).

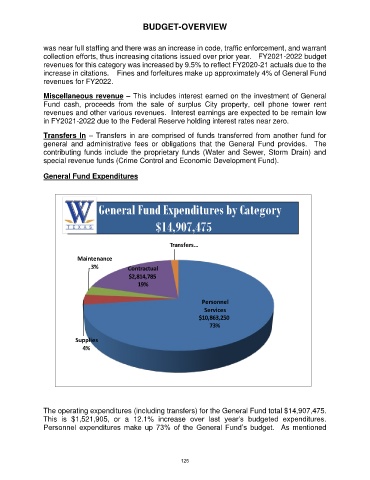

General Fund Expenditures

The operating expenditures (including transfers) for the General Fund total $14,907,475.

This is $1,521,905, or a 12.1% increase over last year’s budgeted expenditures.

Personnel expenditures make up 73% of the General Fund’s budget. As mentioned

125